State of the Industry 2019: Pizza offers more options, healthier crust alternatives

From cauliflower crusts to premium ingredients, the pizza category is changing for the better

The world of pizza is growing more diverse. The industry is more accommodating toward those with Celiac disease or who prefer to eat gluten-free, and mainstream consumers now have a variety of crusts to choose from, to boot.

Overview | Bread | Tortillas | Sweet Goods | Snack Cakes | Pizza | Desserts | Cookies | Buns & Rolls | Bars | Breakfast Products

Market data

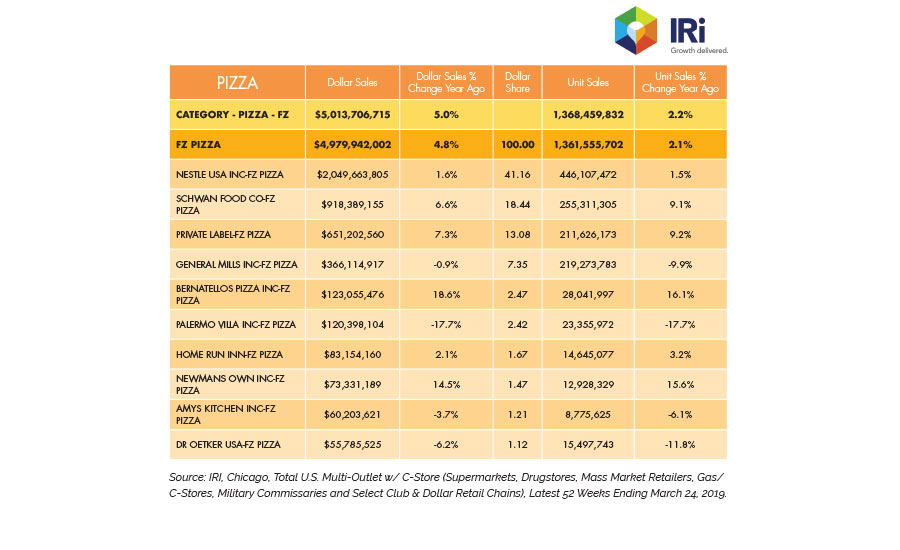

According to data from IRI, Chicago for the past 52 weeks ending March 24, 2019, the frozen pizza segment increased by 4.8 percent to $5.0 billion. Nestlé far and away leads the pack, up 1.6 percent to with $2.0 billion in sales. Its DiGiorno brand grew by 2.6 percent to $1.1 billion, and Jack’s grew 3.8 percent to $270.5 million. Schwan’s Co. also saw growth, up 6.6 percent to $918.4 million. Its Red Baron brand grew 8.9 percent to $647.2 million. The Tony’s brand also saw a good year, up 12.5 percent to $109.5 million. Private label frozen pizza made $651.2 million, up 7.3 percent. And Caulipower has stormed onto the frozen pizza scene, with 429.8 percent growth over the past year to $47.8 million.

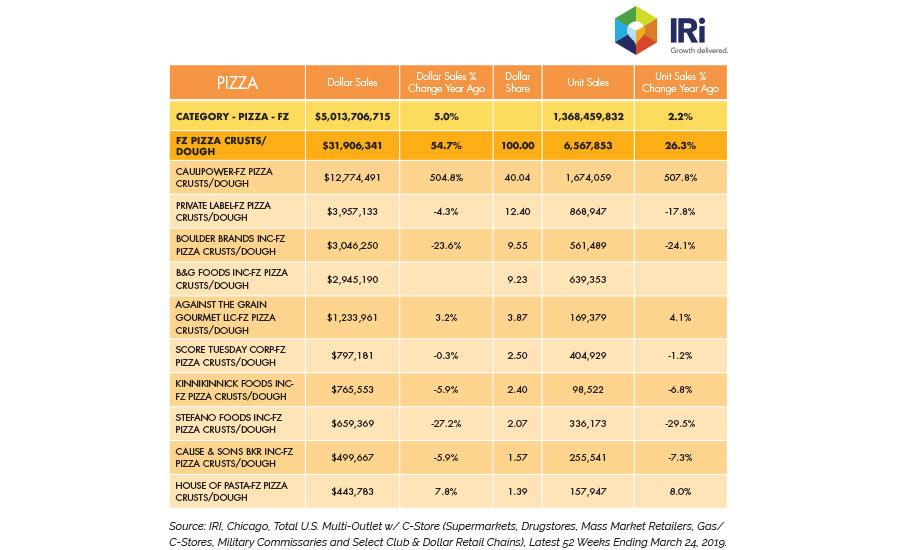

The frozen pizza crusts and dough segment grew by 54.7 percent to $31.9 million, largely thanks to Caulipower, which now leads the segment, up 504.8 percent to $12.8 million. B&G Foods entered the cauliflower pizza crust market last year with its Green Giant brand and saw $2.9 million in sales. Against the Grain Gourmet, which also specializes in gluten-free bakery products, saw its pizza crust grow 3.2 percent to $1.2 million.

Refrigerated pizzas saw another down year, dropping 3.9 percent to $342.6 million—but some companies are finding success in the segment. Champion Foods saw its Family Finest Take N Bake line grow 16.4 percent to $5.1 million, but its Make N Bake line dropped 23.4 percent to $1.1 million. Nardone Bros. grew its take-and-bake line 18.3 percent to $4.8 million. Vicolo also had a good year in the segment, up 32.3 percent to $4.2 million.

Looking back

On the macro level, one of the most-important trends today is the evolving definition of quality, says Michael Gunn, director of culinary, research and development, Schwan’s Co., Marshall, MN. “A wide range of things drives this trend, but the end result is that consumers are continually raising the bar. Consumers care about how their food is made, and what ingredients and processes are used to make it. When they look at the list of ingredients, they only want to see the things that are ‘supposed’ to be in there—things they could find in their own pantries. Some consumers care deeply if those ingredients are sustainable and ethically raised.”

On a micro level, there’s a lot of interest in vegetable-based crusts, adds Gunn. “This reflects interests in ingredients, but can also address other desires like specific diet requirements or even wanting ‘hidden veggies.’ Cauliflower has the most attention right now, but I think the door has been thrown wide open for innovation when it comes to the consumers’ willingness to try non-traditional crust. The only caveat is that the crust must still deliver on a delicious and high-quality pizza experience—people ultimately want pizza that tastes good.”

The cauliflower crust trend is indeed alive and well, with Caulipower performing well in frozen pizza and frozen pizza crusts. Other companies are also entering the market. In August 2008, Oprah released her O, That’s Good! line of frozen pizzas, which use cauliflower in the crust.

Broccoli crust pizzas are also hitting the market. In October 2018, Spinato’s released its broccoli crust pizza, with various topping combinations.

Other interesting additions to the category included Smart Flour’s cauliflower and ancient grain pizza crust, released in 2019, and Quest Nutrition’s keto-friendly pizza, released in November 2018.

Pizzas are trending toward higher-end versions, says Glenn Shelton, vice president/general manager, Lawrence Equipment, South El Monte, CA. “Thin and crispy continues to gain in popularity, although we don’t know whether that’s due to people wanting to consume less calories, or liking the ‘crunch’ that a properly prepared thin and crispy pizza provides.” Trends in pizza that were nearly nonexistent just two years ago include gluten-free cauliflower pizza crust, as well as other gluten-free crusts and doughs, he adds.

According to Technomic, 43 percent of consumers enjoy pizza weekly, and yet 49 percent want more authentic offerings—specifically pizza made with nutritious, locally sourced, high-quality ingredients, says Kerry Olson, vice president of foodservice sales, Emmi Roth, Monroe, WI. “Transparency and the need for operators to use authentic, clean and natural ingredients continues to be one of the top trends in the category. This trend is especially true for the millennial demographic, who are willing to pay more for specialty foods made with ingredients that are sustainably sourced.”

Emmi Roth provides organic pizza cheeses and a number of uniquely flavored cheese under the Kindred Creamery brand. The brand is known for its Cow’s First program, which sources milk from local dairy farmers, who “treat their cows like family,” notes Olson, combining traditions of family farming with modern technology.

Randy Medina, pizza application specialist, Grote Co., Columbus, OH, notes that the growth seen in frozen pizza is driven by younger consumers wanting convenient, yet healthy, flavorful foods cooked at home. “Processors continue to differentiate ingredients and toppings, sourcing alternate, ethnic, diet-specific, time of day, and specialty products.”

All of these trends lead pizza manufacturers to invest in automation equipment to keep up with demand and speed-to-market requirements—not to mention the flexibility that’s essential for more and shorter runs, Medina adds. “More agile, smaller manufacturers are getting market share and forcing larger counterparts to rethink their processing operations to address these contradictory pressures,” he says.

“We’re seeing a combination of simplification and imagination—more specifically, simplification of ingredient legends and processing methods, and imagination when it comes to topping combinations and sensory experiences,” says Matt Patrick, technology, applications research, and technical services, Delavau Bakery Partners by SafPro, Piscataway, NJ.

Delavau’s Encore line of products can help pizza makers achieve cleaner labels by eliminating ingredients like sodium stearoyl lactylate (SSL) or azodicarbonamide (ADA), Patrick explains.

“We’ve also created a clean-label solution that can help create microwaveable pizza crusts that no longer need a susceptor board to achieve a crispy crust. Our Encore Plus solution yields pizza crusts that, even straight out of the microwave, are tender with a crispy edge and a well-rounded artisan-bread-like flavor profile,” says Patrick.

On the sensory front, Delavau’s technical team works alongside pizza makers at its East Coast Baking Center in Piscataway, NJ, or at the Pizza Innovation Center that its parent company, Lesaffre Yeast Corp., opened near Chicago in conjunction with the North American Pizza and Culinary Academy. “The Pizza Innovation Center features a variety of equipment, including several types of mixers, dough handling equipment and ovens,” says Patrick. “Additionally, the center’s dough preparation room can replicate any climate, which is particularly valuable when troubleshooting formulations or testing new innovations.”

Looking forward

“Healthier choices and convenience will continue to drive demand,” remarks Patrick. “In addition to our susceptor board elimination technology, we’ve developed a clean-label sodium reduction solution in our Accent line.” This lets pizza makers deliver a more-attractive nutritional profile, he notes. Delavau also works with its partners to optimize their formulas, ensuring that the sensory experience is what the developer intended and that label and menu claims align with current shopper demands, he notes.

Equipment and ingredients are incredibly important, says Gunn. “On the ingredient side of the equation, you have to source ingredients that support the ‘story’ you want to tell about your product. This might include organic, non-GMO or even being able to identify the farmers that grew it.” There is also the technical challenge of removing ingredients such as preservatives and chemical leavening deemed unattractive to target consumer demographics—aspects that can affect cost, shelf life and the production process, he explains.

Equipment can also be the key to meeting customer quality expectations, Gunn adds. “Cleaner ingredient statements can mean longer fermentation and gentler handling of dough. This could require modifications to the current process and equipment. And if manufacturers want to produce a vegetable-based crust, having the right equipment is key to delivering a crust that meets consumer expectations of a great pizza.”

Shelton says that in every case, perfection can only be achieved with the balance of consistent ingredient quality and pizza formula made on the equipment best suited for the products. He notes that Lawrence automated pizza systems are fully integrated with a software overlay control package to manage production efficiency and product quality to meet the baker’s goals.

Medina says that we will continue to see today’s trends extend into the future. As younger customers increase their buying power, manufacturers will still need to meet their desires for health-conscious, quality frozen pizza. “Technology will continue to advance and become more accessible to manufacturers of all sizes, which will drive more efficiency and production. Robotics and AI will be in the conversation, but we don’t see them becoming more mainstream in North America for a few more years.”

With pizza manufacturers tasked to create a wider diversity of products, faster and more safely, they often can’t scale production efficiently without automation. Grote’s pizza topping equipment is designed and manufactured with their needs directly in mind, Medina says. “Lines can scale from less than 45 up to 300 pizzas per minute and are dependable for long runs. Alternatively, changeovers and sanitation are quick between SKUs. We also test with our customers’ different products, so they are confident our equipment works for each of the recipes.”

As for upcoming trends, Gunn said we will continue to see the vegetable-based crust trend move beyond retail and into foodservice. “I also think you will see the continued growth in the popularity of higher-quality, more-traditional protein toppings like prosciutto, pancetta, capicola and salami. They deliver great flavor, add visual interest and are perceived as being more artisan and authentic.”

Olson says that the growth of regional pizza styles and use of unique specialty ingredients is another top trend in the pizza industry that will continue to help manufacturers and operators set themselves apart from the competition. “While mozzarella is without a doubt one of the most-popular cheeses used on pizza nationwide, regional operators may explore the use of alternative melting cheeses. Raclette, for instance, is known for its mild flavor and excellent melting capability. It is also incredibly aromatic and visually appealing,” she says.

Olson also says that flavorful cheeses will continue to build interest with consumers. “We see this trend impacting foodservice, too, as regional pizza operators explore the use of more unique-flavored cheese like Roth Smoked Moody Blue, spicy Roth Sriracha Gouda or Roth Chipotle Havarti on pizzas and flatbreads.”

When it comes to streamlining production, convenience is key, says Olson. “We offer pre-packaged, shredded cheese blends—Roth Ultimate Firehouse Shredded Cheese Blend—to make it easy for pizza operators to quickly create high-quality, flavorful options for their customers.”

Whether you’re in the mood for a Detroit square pizza, Chicago deep dish, or maybe something healthier like a cauliflower crust, the pizza category will continue to expand, and consumers will be the ones to benefit.

Overview | Bread | Tortillas | Sweet Goods | Snack Cakes | Pizza | Desserts | Cookies | Buns & Rolls | Bars | Breakfast Products

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!