State of the Industry 2019: Bars continue to innovate

Whole food ingredients pave the way for a functional future

Snack and nutritional bars are not only growing in popularity, but they represent an innovative category that keeps up with trends and is rewarded for its creativity. “A decade ago, food bars primarily targeted athletes, diet-specific consumers and the morning daypart,” says Jennifer Williams, marketing director domestic advertising, California Walnut Board and Commission, Folsom, CA. “Today, bars are formulated for all eating occasions, from an on-the-go breakfast option to a mid-morning snack and a dinner meal replacement.” And as these eating occasions have expanded in snack-fueled diversity, so has the consumer base.

Millennials, for example, are a key demographic, especially as they become parents, says Pam Stauffer, global marketing programs manager, Cargill, Minneapolis. “For millennials, snacking is a lifestyle, and they consume significantly more snacks than their baby boomer parents. They’re not, however, looking for junk food.” And this is where bars can enter the picture.

Overview | Bread | Tortillas | Sweet Goods | Snack Cakes | Pizza | Desserts | Cookies | Buns & Rolls | Bars | Breakfast Products

Market data

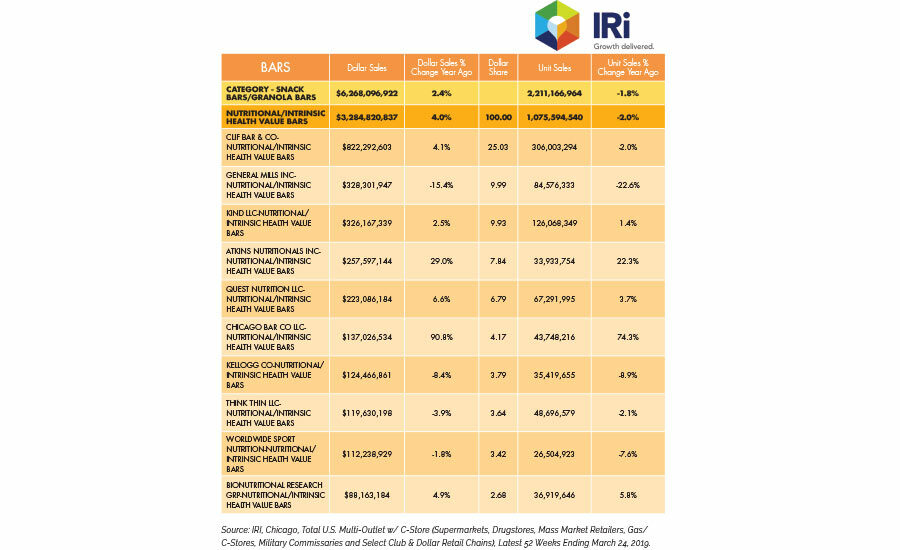

According to IRI, Chicago, sales of snack bars overall grew 2.4 percent to reach over $6.3 billion in the 52 weeks ending March 24, 2019. While some subcategories did suffer—for example, granola bars posted a 4.5 percent sales decline to $1.6 billion in sales—most were on the rise. Top growth was seen in breakfast/cereal/snack bars, which grew 7.2 percent in sales to $1.4 billion. The leader in this segment is Kellogg Co., which posted 1.5 percent growth to $623.1 million. Private label notably grew 26.2 percent, and KIND leapt 44.0 percent.

The most-dynamic area when it comes to bars, though, is in nutritional/intrinsic health value offerings, which grew 4.0 percent in sales and accounted for $3.3 billion in sales. CLIF Bar far and away leads the pack and posted 4.2 percent in sales growth to $822.3 million. RxBar—a Kellogg Co. business, but listed separately by IRI as Chicago Bar Co.—had a great year, up over 90 percent to $137.0 million.

“Bars are some of the strongest performers in the industry right now due, in large part, to a sense that they offer greater health benefits and a nutritionally dense meal replacement,” says Laura Tagliani, director of science and compliance, Quintessence Nutraceuticals, Carmel, IN. So it makes sense that top trends driving the market revolve around health.

Looking back

In a category previously colloquially known as “protein bars,” it’s no surprise that protein is still a top trend in this category. “No longer the sole purview of sports enthusiasts, mainstream consumers are attracted to the perceived health benefits associated with protein, including weight management, muscle building and longer-lasting energy,” says Stauffer.

But today’s proteins don’t necessarily look like those of the past as plant proteins take center stage. According to Stauffer, new plant proteins fit in well with current trends. PURIS pea protein, for example, gives formulators a non-GMO, organic, sustainable, vegan, gluten-free and soy-free option, making it very label-friendly, she says.

Along these same lines, consumers still seek out fiber in their nutritional and snack bars. The challenge? “Many of the fiber sources used in bar formulation may impact flavor,” Stauffer says. To that end, Cargill offers Oliggo-Fiber chicory root fiber, which won’t affect taste or texture, she says, plus it’s clean-label and can aid in sugar reduction.

“Sugar reduction is one of the most critical industry-wide trends, and it’s very pertinent to bars,” says Paul Verderber, senior vice president of sales, Carolina Innovative Food Ingredients (CIFI), Nashville, NC. “Consumers use bars to meet their health and wellness objectives and will likely avoid bars with sugar content that they deem too high.”

In response, CIFI offers a sweet-potato-based sweetener, which also adds fiber content and serves as a replacement for grains—and some consumers avoid gluten even if they don’t have to. Because of this, demand has grown for multifunctional gluten-free ingredients. “Our Carolina Craft sweet potato flour, for instance, is seeing strong interest due to its potential to support gluten-free bars,” says Verderber.

Another sweet solution is adding fruits to a bar formulation, since the sweetness they provide won’t be listed in the “added sugars” section of the nutrition label. “Fruit is also well accepted and liked as an ingredient and, depending on the format used, it can also contribute to dietary fiber,” says Jeannie Swedberg, director of business development, Tree Top Ingredients, Selah, WA. “Having fruit on a bar label is an asset.”

As a bonus, fruit is a whole food ingredient that’s recognizable on the label, says Williams. Many fruits also naturally pair well with nuts, which represent another leading ingredient and flavor trend in the bars market. As she points out, walnuts are flavorful, carry a strong nutrition profile and, like fruit, are recognizable to consumers.

“We are seeing greater emphasis on whole, natural ingredients,” says Jeff Smith, director of marketing, Blue Diamond Almonds, Global Ingredients Division, Sacramento, CA. “Today’s consumers are paying attention to the label and looking for bars that can satisfy their cravings without added sugars or artificial flavoring.” He says fruit and nut pairings like almonds and apricots or cranberries can offer a sweet and salty balance, in addition to well-rounded nutrition.

To meet demand for whole ingredients and high protein, Blue Diamond recently launched Almond Protein Powder. In addition to protein, it offers magnesium, phosphorus, manganese and copper, as well as fiber, potassium, calcium iron and zinc. It’s also gluten-free, dairy-free, soy-free and non-GMO. “We expect plant-based proteins to take center stage in the years ahead, and see a real opportunity for almond protein powder to transform this space, as the ingredient fills a genuine need for a better-tasting, more natural protein source,” Smith says. And while many other protein supplements require flavor masking agents, which negatively impacts clean label, Smith says the new almond powder “has a clean taste and an extra-fine texture smooth enough for any application without the need for masking agents.”

Whole-food ingredients reign supreme in the bars space right now. “Consumers are more concerned with the ingredients and clean-food credentials of their protein bars and snacks than the numbers on the Nutrition Facts panel,” says Bill Keith, CEO and co-founder, Perfect Snacks, San Diego, CA. “For example, they’ll opt for organic honey versus sugar alcohols.”

Looking forward

The clean-label trend is not going anywhere in the years ahead. Short and easy-to-understand ingredients lists will be the baseline for bars, says Stauffer, and interest in certifications like Non-GMO Project Verified and USDA organic will likely grow. “At the same time, customization will only increase, as consumers look for bars that provide nutrients for specific conditions or address eating trends like the keto or paleo diet,” she adds.

In this way, we may see a shift from claims boasting high protein or fiber to those that emphasize well-rounded and balanced nutrition alongside functional benefits. “Sustainable energy, raw bioavailable vitamins and minerals, cell oxidation support, probiotics, full ‘greens’ or vegetable serving formats, age/gender/lifestyle targeted products, and products that help prevent or combat specific ailments or health conditions are some examples,” says Philip Caputo, marketing and consumer insights manager, Virginia Dare, Brooklyn, NY.

Partly, this is a result of consumers seeing food as medicine, and seeking products for overall wellness. But their interest will also gravitate toward bars that can offer condition-specific benefits, says Caputo, like cardiovascular, digestive, cognitive, immune and antioxidant support.

This is a trend that is crossing over into bars from the trail mix category, says Williams, where providing omega-3 fatty acids is a common claim. “We think food bars can capitalize on this trend by using walnuts to formulate a bar with significant levels of omega-3 fatty acids,” she says.

“We are seeing trends that point to more functional ingredients,” says Tagliani—ingredients that are “nutrient-enhanced, promoting digestive health, increasing protein or fiber, and playing a role in the management of health-related conditions.” In fact, she says, consumers are increasingly preferring food sources, like bars, over supplements in an effort to meet these needs. Quintessence Nutraceuticals offers a Nutralso ingredient, which enzymatically hydrolyzes complex proteins into simple proteins, making them more digestible, while also delivering over 70 antioxidants, carbohydrates, dietary fiber and antioxidants.

In addition to bars that can meet specific wellness goals, bars formulated specifically for kids are on the radar going forward. Perfect Snacks, which has offered refrigerated protein bars for nearly 14 years, is branching out into kids snacking category. “With Perfect Kids, we’re meeting the needs of those same consumers who are seeking fresh snacks for themselves and also want them for their kids,” Keith says. “Perfect Kids delivers on nutrition and taste, while also providing kid-specific superfoods that parents are trying to get in their kids’ diets.”

Another trend on the horizon is the inclusion of vegetables in bars. Clextral USA, Tampa, FL, has been developing solutions for adding flavor, texture and nutritional aspects to bar formats. “Clextral has a patented technology that enables the integration of solid inclusions greater than 0.5 mm in expanded extruded snacks and bars,” explains Jose Coelho, president. “The twin-screw extruder, as an infinitely adaptable processing machine, is able to accommodate these demands for ingredients and processing parameters to meet these trends.”

In the end, bars are expected to remain strong in the years ahead. “While the bar market is mature in many ways, there is still innovation going on in the sector,” says Swedberg. “This will undoubtedly continue as long as convenience remains a strong consumer desire. People want to eat on the go and, frankly, bars are convenient. If bars fill the consumer need for products that are convenient, nutritious and satiating, then they will find a willing audience.”

Overview | Bread | Tortillas | Sweet Goods | Snack Cakes | Pizza | Desserts | Cookies | Buns & Rolls | Bars | Breakfast Products

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!