Bagel sales hold steady as BFY brands deepen connections

While traditional products continue to sell, consumers increasingly are reaching for better-for-you items.

Courtesy of Sola

Bagels in the past have been associated with breakfast; now, however, consumers are munching on the round baked treats throughout the day. What’s more, the traditionally carb-heavy category has broadened to include better-for-you bites—low-carb, organic, whole-grain, high-protein, and more. Those health-conscious innovations (along with seasonal launches, creative flavor introductions, fun brand collaborations, and other novel notions) are helping to keep the bakery category going strong.

Market data

Center-store bagels saw a slight decline over the 52-week period ending September 8, 2024; the $1.8 billion in dollar sales constituted a 1.3% drop for the time period. Unit sales declined at nearly the same rate—the 442.5 million units moved for the year was 1% fewer than the previous time period. There were losses and gains among the top-ranked brands:

- Grupo Bimbo: $930.7 million, a decline of 4.5% in dollar sales

- Flowers Foods: $184.1 million, a healthy sales increase of 6.2%

- U.S. Bakery/Franz: $39.9 million, a drop of 4% in sales

Other notables: private-label, center-store bagels ticked up a modest 1.5% to reach $476.8 million in sales. Also, Schar USA’s gluten-free bagels hit $8.4 million, which constituted an impressive 15% increase for the year.

Perimeter bagels had a lower total sales figure than their center-aisle counterparts ($310.9 million in dollar sales); however, the subcategory enjoyed a notable increase for the 52-week period of 4.1% compared to the previous. Private-label bagels led the way with the majority share--$307.1 million, an increase year-over-year of 4.4%. The ranked companies had a few losses, but also some smaller players saw triple-digit gains—while their sales were lower (especially compared to the big players atop the center-store bagels rankings) the increases just might place them in the “producers to watch” column:

- Tribute Baking Co.: $2.9 million, a decrease of 7.1%

- Between Rounds: $711,573, an increase of 11.3%

- Melones: $126,127, a 165% dollar-sales increase

The frozen bagels subcategory, which enjoyed $70.6 million in sales (up 8.5% compared to the previous period), saw a lot of ups and downs:

- Private label: $40.5 million, up 14.8%

- O’Doughs: $8.2 million, up 18.3%

- Conagra Brands: 6.5 million, a 5.4% decline

Looking back

While on average bagel categories and various subcategories performed steadily for the 52-month time period, consumers seem to be more interested in bagel products (center store and perimeter) that offer a balance of good taste, and good health.

“We know that across categories, consumers look for options that contain organic ingredients and whole grains while delivering a delicious product they look forward to eating,” remarks Cristina Watson, senior director of brand management for Flowers Foods brand Dave’s Killer Bread. “Bagels, especially, are a place where flavors can be explored and we have our own take on some of the category favorites.”

The Sola Company, a bread producer that focuses on BFY offerings, offers a bagel line among its portfolio of bakery goods for health-conscious items. In September, the growing brand launched five of its top-selling offerings into Whole Foods Market stores, including three bagel flavors (Plain, Blu-Berry, and Everything). The items provide 14-15 g of protein and 4-6 grams of net carbs. Additionally, the products incorporate natural sugar alternatives for clean-label carb reduction.

“Our mission has always been to provide customers with the best possible bread, and collaborating with Whole Foods Market allows us to do just that. We believe that everyone deserves to enjoy the foods they love without sacrificing their goals for a healthier lifestyle,” says Kevin Brouillette, president of Sola.

Dave’s Killer Bread bagels tout BFY bona-fides on the wrapper—relatively high whole-grain content, up to 12 g of protein per serving, shunning high-fructose corn syrup, and more. The portfolio, according to Watson, also attempts to offer a fun bagel-eating experience balanced with the appealing taste.

“Our Epic Everything bagel isn’t just a run-of-the-mill everything bagel,” she comments. “It has a savory garlic and onion flavor, but features chia and quinoa for a nice crunch and added nutrition.”

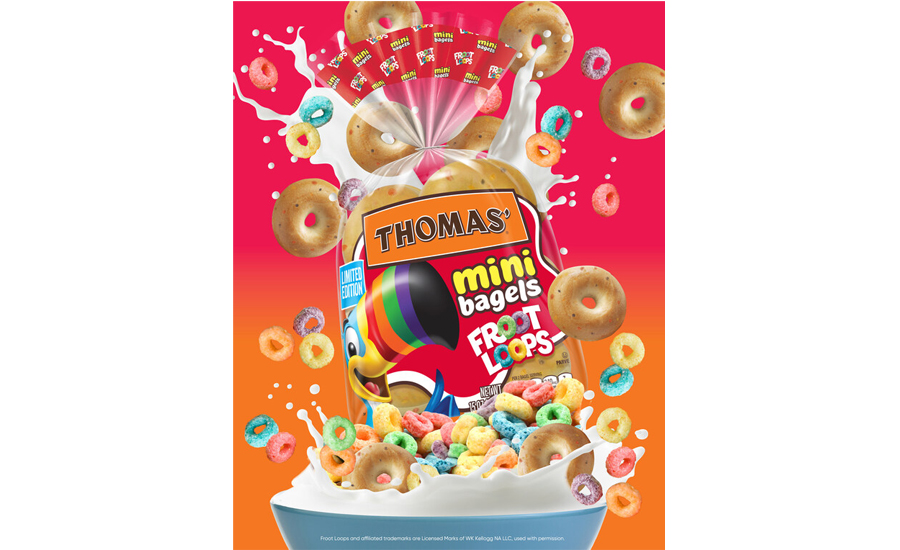

Bagels also frequently are considered a comfort food, whether they fall in the BFY column or skew more traditional in their ingredients. Brands frequently mix things up by introducing seasonal iterations, limited-time flavors, and brand collaborations. In October, Thomas’ (a Bimbo Bakeries brand) introduced Froot Loops Mini Bagels, which combined a traditional bagel with the colors, fruity flavors, and cereal crunch of the WK Kellogg cereal.

"As the most important meal of the day, we believe that breakfast is an occasion to be savored," comments Jinder Bhogal, senior brand manager for Thomas'. “Thomas' wants to inspire more delicious ways to enjoy moments spent together at the kitchen table, especially for our younger fans. We're dedicated to bringing new and innovative flavors to our consumers and can't wait for fans of both Thomas' and Froot Loops to fall in love with our new Mini Bagel offering.”

In August, Thomas’ got a jump on the autumnal pumpkin spice trend by bringing back its Pumpkin Spice Bagels (which debuted in tandem with its Pumpkin Spice English Muffins. In other notable bagel launch news, another Flowers brand, Wonder, debuted its own twist on bagels earlier this year in April. The line includes three different flavors: Classic, Everything, and Blueberry.

Looking ahead

Watson says that like other brands in the Flowers Foods Family, Dave’s Killer Bread constantly strives to keep its fingers on the pulse of consumer trends when planning future products and varieties.

“We work closely with our Consumer Insights team, consistently monitor sales trends and data, and take time to listen to consumers through social media, consumer emails, and buyer feedback,” she relates. “We also pay attention to what’s happening in other categories across the grocery store. These various pieces of information help us make fact-based decisions that are relevant to consumers while ensuring we maintain the value propositions that make our brand and products unique.”

Foodservice may be a good sector to watch for future in-store bagel trends. Fast-growing chain PopUp Bagels, for example, has engaged in numerous, notable collaborations involving its signature baked goods and custom-blended cream cheese “schmears” with producers like Mondelēz International, Ferrero, and others. Also, earlier this year, Pizza Hut partnered with Los Angeles-based bagel purveyor Yeastie Boys on the limited-time Big New Yorker Pizza Bagel, pointing at the bagel’s appeal outside breakfast occasions.

And, Watson continues, bagels are an area Flowers Foods feels is rife for product innovation.

“We are always looking for ways to bring new products to our DKB fans,” she states. “As bagels are one of our fastest growing product groups, we have a few new items in R&D development.”Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!