State of the Industry 2017: Pizza producers continue to innovate

Consumers seek new ingredients, including some better-for-you options, as retail and foodservice influence one another.

courtesy of Nestlé USA Inc.

courtesy of Linde LLC

courtesy of Nestlé USA Inc.

Frozen Pizza sales

Frozen Pizza Crust/Dough sales

Pizza kit sales

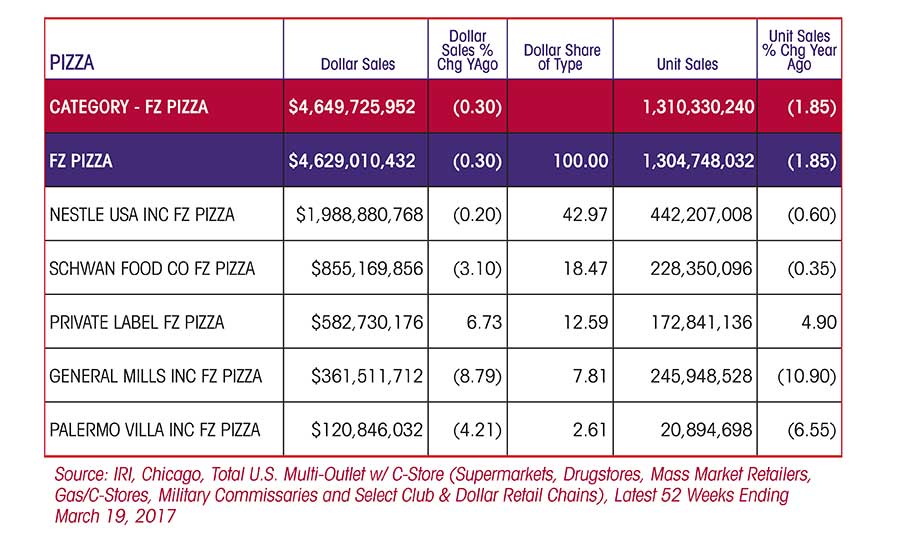

While select brands showed stronger-than-average performances over the past year, the overall frozen pizza category—including frozen pizzas and frozen pizza crusts/dough—has leveled off in sales. Nevertheless, frozen pizza remains a highly profitable retail segment worth over $4.6 billion.

Overview | Bread | Tortillas | Sweet Goods | Snack Cakes | Pizza | Desserts | Cookies | Buns & Rolls | Bars | Breakfast Products

Refrigerated take-and-bake pizza product sales took a hit, as did shelf-stable pizza crusts, while refrigerated pizza crusts and dough saw a good gain, demonstrating a strong desire for speed-scratch pizza creation at home by today’s shoppers.

Frozen pizza brands continue to be influenced by foodservice operators as consumers demand more similarity in quality, while pizza restaurant chains continue to move into the grocery freezer case with their own branded products. And retailers, especially those at the higher end of the market, are successfully competing across nearly every pizza segment with their own private label products.

Market data

For the 52 weeks ending March 19, 2017, per IRI, Chicago, frozen pizza dollar sales fell slightly, by 0.30 percent, to $4.6 billion. Frozen pizza crusts and dough dollar sales also fell, by 1.16 percent, to $19.7 million in sales. These figures show the category leveled off significantly after a strong year of growth; the 2016 State of the Industry report saw 3.03 percent growth for frozen pizza and 21.94 percent for frozen crust/dough.

Nestlé still holds a commanding lead in frozen pizza, with over 40 percent of market share. The top-selling brand in frozen pizza is Nestlé’s DiGiorno, which had sales of $1.05 billion, up 1.83 percent from a year earlier. Private label frozen pizza sales saw a good year, with a sales total of $582.7 million, up 6.73 percent. The fastest-growing brands included Tony’s, from Schwan Food Co., up 17.96 percent to $80.0 million, and Nestlé’s Lean Cuisine, up 12.61 percent to $69.3 million in sales. The super-premium Brew Pub Lotzza Motzza brand from Bernatello’s also saw a good year, up 8.17 in dollar sales to $47.3 million.

The top-selling brand of frozen crusts and dough was Udi’s, a gluten-free line, which sold $4.94 million, down 11.26 percent, while frozen private label crusts and dough sales rose dramatically, by 28.7 percent, to $4.02 million. Other top performers in the segment included Against the Grain Gourmet—a gluten-free/free-from supplier—up 14.20 percent to $1.1 million, and Perrotta Bakery, up 42.3 percent to $141,518 in sales.

At foodservice, pizza is most prevalent at QSRs, appearing on one-third of menus, although that’s also the only segment where pizza has been declining over the past decade, according to Mike Kostyo, senior publications manager, Datassential, Chicago. Pizza has been growing in fast-casual, and menu penetration has risen to 22 percent even at fine dining, a 14 percent jump in the last 11 years, he says.

“It’s not surprising that pizza is growing at fine dining when you consider how pizza is changing,” Kostyo says. “Now the hottest trends in pizza are premium options: flatbreads, Italian meats, artisan cheeses. BBQ chicken and veggie pizzas are actually more common on menus today than pepperoni or supreme pizzas.” Pizza has also risen a whopping 59 percent on breakfast menus in the past four years, according to Datassential.

Technomic’s “Pizza Consumer Trend Report” uncovered one reason why, finding that 26 percent of 18- to 34-year-olds say they would be likely to order pizza for breakfast or lunch if it were offered.

Looking back

Consumer preferences continue to run toward foods that are either already prepared or easy to prepare, says Steve Pickman, public relations manager, MGP Ingredients, Inc., Atchison, KS. “The convenience factor is still huge. There’s still high demand for new pizza varieties, whether that be pizza toppings or other ingredients, or the types of crusts that are available. The flatbread pizzas seem to be gaining momentum.”

Category leader DiGiorno last summer rolled out Artisan Style Melts that are essentially smaller-serving pizzas which can be baked or microwaved. Flavors include Spicy Sausage Pomodoro, Quattro Formaggi, Pepperoni Speciale and Chicken Bruschetta. The company also goosed sales with two new varieties of its pizzeria! thin-crust line: Spicy Sausage Italiano & Provolone and Chicken Parmigiana.

The frozen pizza category has seen a great deal of consolidation among major companies, but midsized, regional players can still do well, despite the difficulty in competing on cost, says Erik Fihlman, program manager, baking and prepared foods, Linde LLC, Bridgewater, NJ. “They need either local branding or some sort of twist that separates it from the half-dozen majors. We’ve seen them be successful with an ethnic twist, or an ingredient twist where you’re eliminating an allergen, like gluten. Younger consumers, at least from what we’ve seen in other industries, are much more willing to test out and try different flavors. You can put just about anything on a pizza.”

MGP Ingredients has noticed a trend toward health and wellness, with an emphasis on clean label and attributes like non-GMO, says Ody Maningat, vice president of research and development, and chief science officer. Consumers are very interested in wheat crust, he says, and they’re becoming more intrigued about gluten-free—although that remains a small percentage. “That’s not to downplay the gluten-free movement,” he says. “That continues to gain momentum.”

At foodservice, Papa John’s has rolled out a gluten-free pizza made with ancient grains, including sorghum, teff, amaranth and quinoa, which was test-piloted at locations across Los Angeles, Phoenix, St. Louis, Houston and Nashville.

Gluten-free requires dedicated equipment, and often physically separated from lines running wheat products, unless a manufacturer wants to run a full sanitation and cleaning process, Fihlman says. “It’s very difficult to incorporate a gluten-free line in and amongst and around a non-gluten-free product,” he explains.

Those who run gluten-free lines need to account for the fact that the rice-based flour used is very caustic and can be damaging to machinery, says Eric Riggle, president, Rademaker USA, Hudson, OH. “There are different things we do to our equipment so rice flour doesn’t damage it and cause premature failure. And you’ve got to be able to clean it. It is so sticky and messy.”

Another common equipment-related issue is ensuring that crusts are frozen quickly and packaged tightly so they don’t absorb moisture and thus become soggy upon thawing, which cryogenic freezing can help to avoid, Fihlman says. “The faster you can do it, typically the better quality you’ll get,” he says. “The faster you get that freeze, the smaller that water molecule is on the surface of the product.”

The right ingredients also can play into ideal defrost conditions, Pickman says. “Pizza manufacturers need to keep the crust fresh and not soggy.”

Equipment makers also need to account for food safety by incorporating features like sloped surfaces and eliminating 90° angles so there isn’t water entrapment and resulting bacteria harborage, Fihlman says. It also helps make the equipment easier and faster to clean. “All those things go into the overhead that ultimately goes into the product cost.”

Looking forward

Going into the future, Technomic’s pizza report shows that more than half of consumers would like to see more restaurants or pizza establishments offer premium toppings or ingredients (59 percent) and all-natural ingredients (58 percent), while slightly less than half (47 percent) would like to see more offerings of locally sourced ingredients.

The report also shows that the health-and-wellness trend is likely to continue, with 59 percent of consumers saying they are at least sometimes concerned with health and wellness when they eat pizza. This rises to 73 percent among millennials, 65 percent among Generation Z, and 65 percent among women overall.

Technomic cites ongoing foodservice trends like premium positioning, with higher-quality ingredients, including all-natural meats and gluten-free crusts; more innovative crusts, such as stuffed or flavored, as well as flatbreads; and the rollout of both breakfast and dessert pizzas.

Similarly, Datassential points to chefs using authentic Italian meats, charcuterie-style ingredients, and veggie-centric offerings, including a boom in the use of kale. Spicy sauces and flavors ranging from buffalo sauce to Calabrian chile peppers have seen marked growth, as well, Kostyo says.

At retail, Fihlman has seen a trend toward take-and-bake that he expects will continue forward, particularly in prepared meals sections of higher-end grocery chains like Shop Rite, Wegman’s or Whole Foods. “It’s assembled, and then cooked and baked, and it gives you the feeling of being homemade,” he says.

Randy Medina, pizza equipment sales specialist, Grote, Columbus, OH, sees more restaurants getting into frozen food, such as Home Run Inn, Geno’s East and Reggio’s. “That trend is going to continue to grow, as restaurants get stronger, and they see what’s happening in the frozen market,” he says.

Consumers increasingly will be expecting their frozen pizza to have similar characteristics to that of foodservice, Riggle says. “It’s the demand for people wanting a better-quality eating experience. That’s why you’re seeing attention paid to more artisan-style crust that’s out there, and more-interesting toppings, like roasted garlic, or whole-milk mozzarella ... the freezer cabinet at the grocery store has changed a lot since I was a kid.”

Overview | Bread | Tortillas | Sweet Goods | Snack Cakes | Pizza | Desserts | Cookies | Buns & Rolls | Bars | Breakfast Products

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!