Discovering new whole-grain textures and tastes

September is Whole Grains Month, the ideal time to take a close look at the changing world of whole-grain ingredients. To analyze ingredient trends, the Oldways Whole Grains Council (WGC) recently mined its database of more than 10,000 products bearing the Whole Grain Stamp. We compared 800 products from 2007–2009 with an equal number of products from 2015, and discovered some interesting trends, showing that manufacturers are moving beyond dependence on a few familiar grains and are now exploring the full palette of textures and tastes that whole grains have to offer.

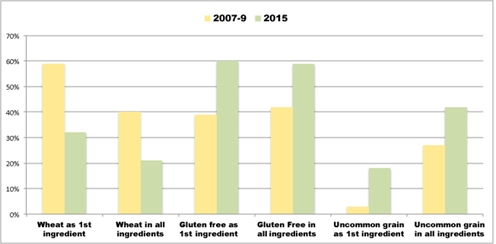

The most startling difference we found was a dramatic drop in wheat as the first ingredient: 59 percent of earlier products using the Whole Grain Stamp had whole wheat as their primary whole-grain ingredient, while only 32 percent of the 2015 products were wheat-centric. As might be expected, gluten-free grains are filling some of the gap: 39 percent of earlier products featured a gluten-free grain, such as brown rice, as the first ingredient, but that number had risen to 60 percent in the 2015 sample.

Is this all due to interest in gluten-free diets? It might appear so at first glance, but other WGC data paint a more-nuanced picture. In the earlier products, just four whole grains—common wheat, corn, oats and brown rice—were the primary grain ingredient in almost all products; only 3 percent of products used a less-common whole grain as their first grain ingredient. By 2015, awareness of the wide universe of whole grains had grown among both consumers and manufacturers, and 18 percent of products used an up-and-coming, less-common grain (something other than wheat, brown rice, corn or oats) as their first ingredient.

Grains showing the biggest increase as first ingredients included several gluten-free grains, such as sorghum, quinoa, millet, and buckwheat. But several gluten-containing grains, including rye, barley and triticale, increased in prominence, too, along with other varieties of wheat such as Kamut khorasan and einkorn. We also looked at grains that were “supporting players” in formulations, beyond the first ingredient, and found a similar trend: grains other than wheat, oats, corn and brown rice made up just 27 percent of all ingredients in 2007–2009, but rose to 42 percent of ingredients in 2015.

Our take? Wheat’s fall from dominance owes a lot to manufacturers’ interest in formulating with a wider range of different grains—and to consumers’ awareness and interest in exploring the different tastes and textures that all whole grains have to offer, whether those grains are gluten-free or not.

A look at some recent products approved for the Whole Grain Stamp illustrates these trends. For example, Deland Bakery, serving the foodservice market, has recently come out with a full line of breads and rolls with millet as the first ingredient, and Udi’s has introduced a Millet-Chia Bread, which also contains amaranth. Until recently, Americans were more likely to encounter millet in their bird feeders than in their bread boxes! Capitalizing on another seldom-used grain, Landau Natural Foods has introduced puffed buckwheat cakes, similar to the more familiar puffed rice cakes.

Whole grain rice isn’t always brown, either, in today’s new world of whole-grain ingredients. Lotus Foods, for instance, has a new line of Arare Rice Crackers that mix brown, white and black glutinous rice with zesty varieties that include Sriracha, Tamari and Thai Sweet Basil. And InHarvest has created granola bars that include puffed red rice, white quinoa, red quinoa and puffed wild rice.

Sprouted grains are also a popular new ingredient for snacks and baked goods. Rarely seen in our earlier group of products, more than 250 sprouted-grain foods are now registered in our Whole Grain Stamp database. In the snacks and baked goods realm, recently introduced examples include sprouted tortilla chips from Way Better Snacks in Ginger Snap and Apple Cinnamon Spice flavors, while ConAgra Foods, Tribeca Oven and Dave’s Killer Bread have all launched sprouted-grain breads.

With innovative products like these to choose from, it’s no wonder that more and more Americans say they’re choosing whole grains more often. According to a recent WGC nationwide survey, 31 percent of consumers say they “always or nearly always choose whole grains when they are available,” with another 32 percent saying that they “choose whole grains about half the time.” (Oldways, 2015 Whole Grains Consumer Insights online survey, August 2015, Survey Sampling International)

And, while 86 percent of those in the same survey cite “health” as one incentive for choosing whole grains, 40 percent cite “taste” as a prime motivator—another tribute to the change in perception of whole grains. As more manufacturers create delectable whole-grain products, more people come to crave the fuller, nuttier taste of whole grains.

That said, only 14 percent of whole grains are consumed as snacks, according to the WGC survey. More than a quarter of shoppers say that availability of whole grains is still a barrier to upping their consumption, however, so there’s still room in the market for even more creative whole-grain snacks and baked goods.

What can your company formulate to meet their needs?

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!