State of the Industry 2019: Snack mix and nut inspirations for category growth

Global flavors, healthy indulgence and dynamic textures top trends in snack and nut mixes

According to the “Top 10 Trend Predictions for 2019” from SPINS, Chicago, internationally inspired innovation in nuts and seeds is gaining ground. SPINS says that nuts and seeds are watch-worthy because they’re not only protein-rich and easy to eat, but they deliver antioxidants and long-lasting energy. Add to this millennials’ penchant for travel and exotic foods, and it’s clear that the snack mix and nuts product categories are poised for innovation and growth.

“Consumers continue to show a preference for clean label and all-natural snack options that offer functional and nutritional benefits,” says Jeff Smith, director of marketing at Blue Diamond Almonds Global Ingredients Division, Sacramento, CA. “These trends are contributing to new growth and innovation in the snack and nut mix category, which is defined by whole, natural and often plant-based ingredients such as nuts, seeds and dried fruits.”

Overview | Chips | Puffed/Extruded Snacks | Popcorn | Snack Mixes & Nuts | Tortilla Chips | Pretzels | Frozen Snacks | Crackers

Market data

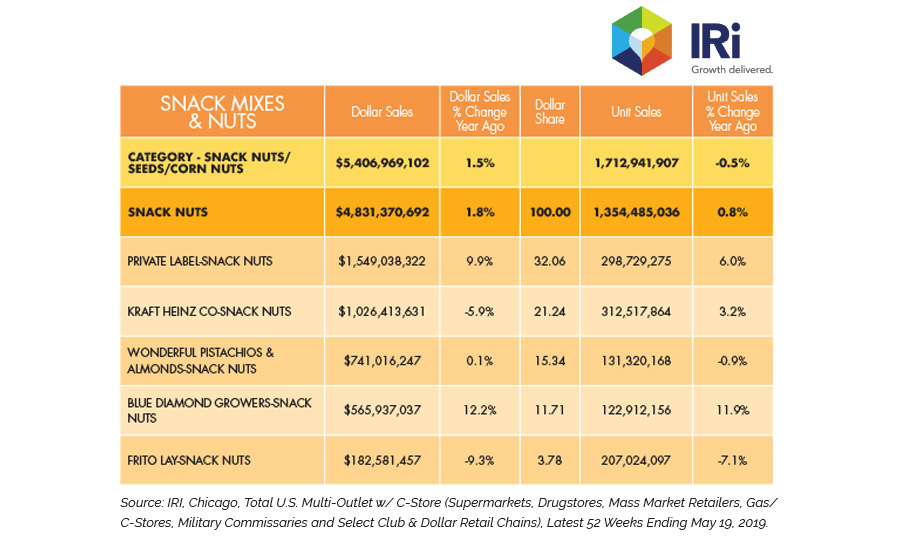

According to data from IRI, Chicago, the snack nuts segment grew 1.8 percent for the 52 weeks ending May 19, 2019, hitting $4.8 million. Private label represents the largest share of the market and saw nice 9.9 percent growth to $1.5 million.

Kraft Heinz leads all branded business in snack nuts with its Planters lines. Planters P3 grew 11.4 percent and is now a $26.8 million brand, per IRI. Blue Diamond saw nice growth of 9.6 percent to $551.5 million.

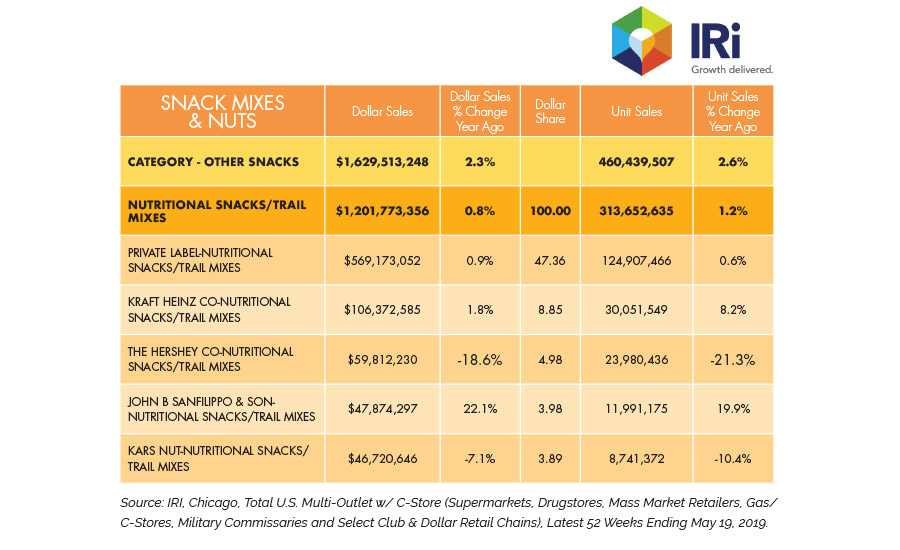

Sales in the nutritional snack and trail mixes segment remained stable, up 0.8 percent to $1.2 billion. Private label saw 0.9 percent growth and $569.2 million in sales for the year.

Planters again leads all brands. The core Planters line was flat, down 0.3 percent at $67.7 million. But its Nutrition line saw 15.1 percent growth to $38.4 million.

Other areas of notable growth include Sahale Snacks, which saw its core line grow 27.9 percent to $31.6 million. And 37.9 percent growth to $28.9 million for the Orchard Valley Harvest brand from John B. Sanfilippo & Son, the 2019 SF&WB “Snack Producer of the Year.”

Looking back

Tom Payne, industry consultant, U.S. Highbush Blueberry Council, San Mateo, CA, sees the market for snack and nut mixes continuing growth. “A variety of things are currently impacting this market, including the quest for ‘new,’ the spirit of adventure, time constraints, the pace of today’s lifestyle, and growing interest in health foods and ingredients. The changing nature of today’s work schedules, including internet-based work time and home office work centers, has resulted in changes and tastes and needs.” And this is good news for nuts.

Smith notes high demand for almonds, including flavored options for consumers showing more interest in adventurous flavor pairings inspired by global cuisines, with a continued emphasis on sweet and savory mixes. Almonds can hold a variety of seasonings and coatings, he says, which makes them highly customizable for any flavor combination, and a valuable asset to snack food manufacturers who want to tap into flavor trends. “Currently, we’re working with manufacturers to help them create products that appeal to consumers’ evolving tastes,” he adds, “including new sweet flavors and a variety of savory flavors such as honey roasted, maple and smokehouse.”

Consumers are also seeking out tart flavors. According to Mollie Woods, executive director, Cherry Industry Administrative Board, DeWitt, MI, dried fruit like dried cherries can help brands meet a tart-and-sweet flavor profile by combining with other components like dark chocolate, pistachios, pecans or almonds.

Similarly, dried blueberries can pique consumer interest, says Payne, especially when teamed up with other antioxidant-rich ingredients like walnuts, pecans, cashews, crunchy grains and chocolate chips. “The natural dried blueberry area, such as freeze-dried and microwave-dried, have a lot of potential with nut mixes and work very well with moisture compatibility.”

Payne also suggests joining blueberries with new flavor profiles from herbs to ethnic spices, to support profiles like curry, salsa, chutney and barbecue. “Trend watchers identify blueberries’ role in adventurous new taste profiles with spices, botanicals, floral and citrus, complementing, enhancing and balancing flavors,” he says. He also suggests combining blueberries with cayenne, garlic, mustard, tamarind, wasabi, mint, tarragon and more.

The snack mix category is seeing innovation in new textures, says Smith. Leading the way are diverse combinations of nuts, seeds, berries, dried tropical fruits, wasabi peas, chia sticks and more, which “create more varied textural experiences for adventurous consumers,” he says.

As buyers travel to other countries in search of new flavors and products, their global interests influence new flavor trends. “What always drives these things is the need to continue growth in a category through new trial and experimentation of customers,” says Christie Frazier-Coleman, vice president of marketing, Lehi Valley Trading Co., Mesa, AZ. In other words, a typical nut mix won’t cut it.

In response, the manufacturer is celebrating the launch of a new line of gourmet nuts, available July 2019: Maple Bourbon Pecans, dipped in a sweet and buttery maple bourbon sauce with a hint of vanilla; Vanilla Cranberry Cashews, offering a berry-and-nut flavor profile; Cocoa Roasted Almonds, which feature fresh almonds rolled on a sweet cocoa coating with a hint of vanilla and butter flavor; Ginger Citrus Almonds, with a glaze of cool citrus and ginger; and Cocoa Coconut Almonds, with unsweetened shredded coconut and cocoa powder.

“Nuts and seeds are a very popular component of the snacking category, and new competitors have entered the arena with gourmet nut options that provide an indulgent or upscale aspect,” Frazier-Coleman says. “This is an opportunity to possibly expand the category.”

Looking ahead

Woods says that one of the greatest opportunities in the snack mix category going forward is offering a healthy option that still allows for indulgence. “Brands are reimagining product innovations that pair a bit of indulgence with natural ingredients that offer functional benefits,” she says. Tart cherries, she adds, can help formulators meet this trend, as they offer unique flavor and robust nutrition.

It’s also beneficial for formulators to include ingredients with a positive story. “Consumers today care more and more about brand stories, including ingredient sourcing, social responsibility, and big brands building relationships with small and/or local producers,” says Woods.

Bringing awareness of the color in fruits and vegetables when describing a product is another up-and-coming trend, one that entices consumers to appeal to their visual senses and not just taste, notes Woods. Cherries are abundant in anthocyanins, the phytonutrients behind their health-promoting properties.

To add assurance for customers, the U.S. Highbush Blueberry Council has launched a new Real Blueberries seal, to call out products that contain real highbush blueberries or real blueberry co-products like purées, juices, concentrates and more. “With heightened awareness of the health benefits of blueberries—antioxidants, anthocyanins, anti-aging, etc.—consumers are looking for blueberry-containing products,” says Payne.

If you ask Smith, future opportunities for growth include calling out health and clean-label benefits on snack mixes, specifically, plant-based and protein-related claims. “We know that almonds play a key role in bringing forward those nutritional benefits and allowing snack manufacturers to appeal to consumers with a variety of specific diet and lifestyle needs,” he says, noting that almonds are high in protein, with 6 grams per serving, and 4 grams of fiber per serving. “Almonds aren’t new to snack and trail mixes, but they will continue to be a value-added and versatile ingredient that syncs with the latest consumer trends for plant-based and all-natural snack products that offer important nutritional benefits.”

Overview | Chips | Puffed/Extruded Snacks | Popcorn | Snack Mixes & Nuts | Tortilla Chips | Pretzels | Frozen Snacks | Crackers

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!