Nutrition and snack bars let consumers have it all

Great taste, high nutrition and on-the-go appeal are all wrapped up in today’s snack bar market

Depending on who you ask, either taste or convenience is king. Luckily, manufacturers of snack, nutrition, granola and other bar products delivering on both counts more often than not these days.

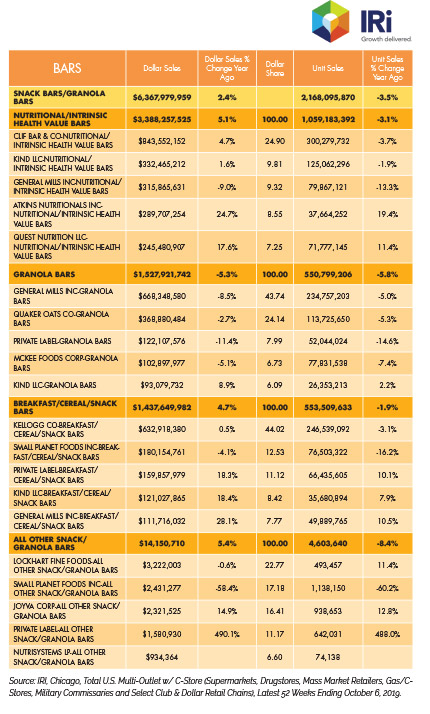

As a result, the market remains on an upswing. According to IRI, Chicago, the overall snack and granola bar category grew 2.4 percent in sales to $6.4 billion in the 52 weeks ending October 6, 2019.

“Bars are a go-to snack that complement consumers’ busy schedules, and the variety of types available, including granola, cereal, energy and sports bars, means that there is an offering to fit everyone’s lifestyle needs,” says Harbinder Maan, associate director of trade marketing and stewardship, Almond Board of California, Modesto, CA.

The largest product segment, nutritional and intrinsic health value bars, grew 5.1 percent to $3.4 billion. CLIF Bar leads the segment and saw an increase of 4.2 percent to $472.4 million. Its CLIF Builders line saw a slight dip, down 0.2 percent to $103.1 million. The CLIF Kid line saw very nice growth of 32.3 percent to $76.9 million. Other notable sales activity for key brands in the segment included Atkins Nutritional, up 25.6 percent to $225.5 million; its Atkins Endulge line grew 21.9 percent to $64.2 million. The General Mills brand RXBAR grew 23.0 percent to $146.6 million for the year.

The breakfast, cereal and snack bars segment likewise performed well for the year, up 4.7 percent to $1.4 billion. Kellogg Co. leads the segment, and its flagship brands saw modest growth, with Rice Krispies Treats bars up 0.5 percent to $632.9 million, and its Nutri-Grain bars up 1.7 percent to $180.2 million. The newcomer Rice Krispies Treats Snap Crackle Poppers line earned $24.9 million in its first year out. KIND saw strength in its primary breakfast bar line, up 14.8 percent to $69.1 million; its KIND Minis line had a great year, up 98.5 percent to $21.8 million.

The smaller “all other snack/granola bars” segment grew 5.4 percent to $14.2 million. This segment is home to many emerging bar brands. Of particular note are Joyva, which grew 14.9 percent to $2.3 million, and private label, up a whopping 490.1 percent to $1.6 million.

“Bars can encompass new dietary trends with agility, launching SKUs that address top consumer demand areas,” says Angela Bonnema, senior scientist, Cargill, Minneapolis. “Today, you’ll see bars that cater to consumer desires for everything from clean label and high-protein to low-carb, keto, Paleo, vegan and plant-based. Bars can meet those consumer demands in a transportable, easy-to-consume product.”

Brad Schwan, senior director of marketing, snacks, baking and cereals, ADM, Chicago, notes that bars also benefit from the fact that consumers see snacking as part of a healthy lifestyle and a convenient way to deliver nutrition. “Many consumers have also become more in tune with their individual health and wellness needs and look for snack foods that not only deliver on taste, but also contain the right mix of functional benefits to help them look and feel their best from the inside out.”

Nutritional ingredients

Schwan says consumers are purposefully prioritizing foods that contain added nutrients like fiber, vitamins, minerals, probiotics and reduced sugars. And, of course, protein still leads the way in the bars category.

“Whey and soy are still widely used, but plant proteins like pea, beans and lentils continue to gain traction,” explains Bonnema, since these types of ingredients tend to also fit today’s biggest product development trends like non-GMO, organic, sustainable, vegan, gluten-free, soy-free and label-friendly. They’re also easier to formulate with than ever before, she says. For example, PURIS pea protein comes from proprietary pea seed varieties specially selected to minimize the off-flavors normally attributed to pulses.

Milk protein is also on the rise with brands, says Joe Katterfield, health and performance nutrition development manager, Arla Foods Ingredients, Viby, Denmark. “Milk protein contains all the essential amino acids, as well as being neutral in taste and highly functional, making it easy to create a high-protein bar without compromising on taste or texture.” The company’s Lacprodan SoftBar ingredient can deliver a bar base with up to 37 percent protein.

Protein that’s free from common allergens can also appeal to brands trying to differentiate, and attract a wide swath of consumers “who seek it for a variety of reasons including sports recovery, weight management and more,” says Stephanie Lynch, vice president of sales, marketing, and technology, International Dehydrated Foods, Inc. (IDF), Springfield, MO. IDF offers CHiKPRO chicken protein, a “versatile and diet-friendly protein,” made from 100 percent all-natural chicken raised on American farms, she adds. Free of whey, soy and other common allergens, the ingredient is also certified Paleo and keto-friendly.

Jeff Smith, director of marketing, Blue Diamond Almonds Global Ingredients Division, Sacramento, CA, notes an increase in demand for Almond Protein Powder and almond butter for use in bars, with the former providing approximately 45 percent protein. Almond Protein Powder is also an excellent source of magnesium, phosphorus, manganese and copper, and a good source of potassium, calcium and fiber.

“Fiber will become an even more important nutrient in this category as eating and evaluating foods for positive digestion and other related health benefits has become a mainstream phenomenon,” says Schwan. “Probiotics and prebiotics are also emerging in snack bars as consumers take an active interest in the microbiome and its holistic impact on their health, from improving mental health to helping inflammation and encouraging skin health.” ADM offers Fibersol, a soluble fiber that boasts superior levels of consumer tolerance.

Cargill offers chicory root fiber, which won’t affect the taste or texture of the final product, says Bonnema.

Whole-food ingredients

“The importance the consumer places on knowing what is in their snacks has led to a demand for more transparency in ingredients used, including more purposeful and nutritious ingredients like whole grains and fruit,” says Pilar Arellano, marketing director, Nature’s Bakery, Reno, NV. And, she points out, as consumers look for more purity in their foods, they want whole-food ingredients like dates or applesauce.

In an effort to balance indulgence with clean label, the brand offers a Brownie Bar, made with whole grains, cocoa and dates. Its Oatmeal Crumble bar is also made with oats, fruit and dates, but boasts 3 grams of fiber and 14 grams of whole grains for those seeking breakfast on the go. “Healthy snacking doesn’t have to be bland,” says Arellano. “To stand out, product developers can incorporate great-tasting flavors into their products to ensure consumers love the product.” The bars are available in flavors like Pumpkin Spice, Cherry, Lemon and Strawberry.

“Whole-food nutrition is one of the prevailing trends in the bar category, which is why we are seeing so many nut-dense bars hit store shelves,” says Jennifer Williams, marketing director, California Walnut Board and Commission, Folsom, CA. “Like most food products, consumers want it all. However, with the bar category, manufacturers can actually deliver by using whole-food ingredients that consumers love for their taste and nutritional profile.” She notes that walnuts offer protein and healthy omega-3s, as well as texture enhancements so the bar isn’t overly chewy or soft.

“As consumers increasingly seek healthier snacking options, product developers look to ‘hero ingredients’ that allow them to mirror consumer demand for plant-based and clean label products,” says Maan. “With their healthy halo, almonds continue to be a popular ingredient for bars, because they offer 15 versatile forms, allowing developers to play with textures.” For example, chewy, crunchy and creamy textures all have appeal, and can benefit from almond protein powder, almond butter or sliced natural almonds. Almonds provide essential vitamins and minerals, 6 grams of protein, 3.8 grams of fiber and 9 grams of healthy monounsaturated fats per 30-gram serving.

A bit of indulgence

It’s always important that snack bar offerings also taste great—especially if consumers use them to satisfy cravings for candy bars. But product developers shouldn’t go too far into indulgence.

“I see two categories becoming increasingly important,” explains Katterfield. “The first contains products that offer ‘healthier indulgence.’ The second—in which bars are formulated without artificial ingredients, but are also high in protein—would be better described as ‘naturally good for me.’” As a result, the consumer base has expanded to non-athletes who are simply looking for a healthier snack, as well as consumers who want to boost their casual exercise with some additional protein in a convenient way.

The bottom line? “Both groups are consuming bars for reasons related to health,” Katterfield says, “and product developers should be careful not to forget this by sneaking in unhealthy ingredients to boost the indulgence factor.”

At Bunge Loders Croklaan, Chesterfield, MO, Mark Stavro, senior director of marketing, says one way to balance these demands is by offering permissible indulgence with a bit of confectionery coating. “When consumers are looking for healthier packaged goods, taste is still a key driver.” He notes that the three-year growth rate for coated bars is four times higher than that of non-coated bars, showing increasing interest among consumers. Plus, he says, brands that offer coated bars can charge a premium.

But it’s not all about sweet. According to Williams, bar brands on the leading edge are offering savory options, especially as bar snacking occasions expand across the day.

And Bonnema suggests keeping an eye on specialty diets. “Bars that cater to specific diets—think keto or Paleo—will continue to find a receptive audience.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!