What’s new in secondary packaging?

Innovations in secondary packaging equipment include vision and scanning technology, as well as automation that simplifies the user interface and machine management. Increased flexibility for package size changes at high speeds is another capability in demand. All of this means that bakery and snack manufacturers can further improve productivity, as their wish lists often include more automation, the flexibility to handle multiple package sizes, the ability to use lighter gauge materials and the need to conform with existing and new regulations.

Several secondary packaging equipment manufacturers recently discussed current packaging trends and shared their innovative ideas with Snack Food & Wholesale Bakery.

Automatic changeovers

“We offer more systems that feature automatic changeover in order to remove human error from the process,” says John Kertesz, Southeast regional sales manager, BluePrint Automation, Colonial Heights Va. “This provides maximum flexibility without the need for several sets of changeparts.”

Kertesz says a good example of equipment with such features is the company’s Delta Robot vertical case packer. After the operator selects a product code in the human machine interface (HMI), the machine automatically adjusts for specific bag and case sizes and pack patterns.

Delkor Systems Inc., St. Paul, Minn., also recognizes the importance of optimizing line operation for maximum efficiencies, says Mike Wilcox, vice president of sales, marketing and aftermarket services. The company continues to add features such as quick tool-less changeovers, vertical startups, servo technology and automation to its equipment.

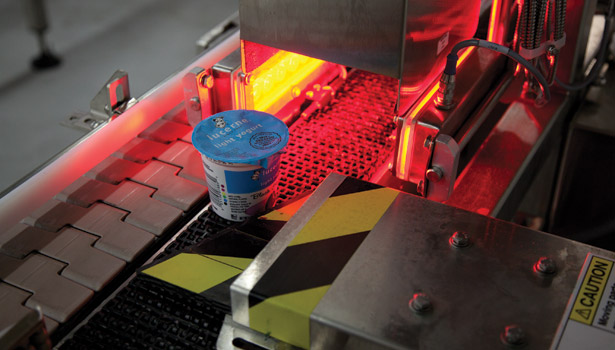

“Another key development is the use of scanning and vision to monitor packaging flow, configuration, quality and location during operation, and manage out defects or flawed packages without shutting the line down,” Wilcox explains. “This not only manages out defective packaging while running, it also detects problems that may cause line downtime.”

Tom Dickman, director of sales and marketing for Stork/Texwrap, a Washington, Mo.-based manufacturer of automated shrink-wrap systems, says his company’s equipment offers integral, improved touchscreen troubleshooting guides, setup videos and maintenance schedules. These facilitate operation and reduce downtime. “Customers are asking for these intuitive and operator-friendly features more frequently,” he notes.

According to Mary Ellen Kerber, marketing services manager at Douglas Machine Inc., Alexandria, Minn., the latest packaging equipment incorporates automatic changeover features that use motors to drive rotary adjustment screws. She cites the company’s Invex IM case/tray packer as one such machine. “This side- or end-load case packer operates with rigid products in wraparound or knock-down, pre-glued RSC [regular slotted container] case blanks,” she explains. “Many snack products are lightweight and use larger cases. This machine handles these larger case sizes and doesn’t use air cylinders for handling the product or forming the case.”

Design challenges

Manufacturers often face challenges when designing equipment for bakery and snack food plants. One reason: Secondary packaging ideally must fit existing packaging equipment in plants, distribution vehicles and retail environments. “The challenge is to provide options that meet budgetary constraints in terms of weight-to-strength ratios within the confines of specific dimensional limitations,” says Glenn Rindfleisch, bakery industry manager at Rehrig Pacific Co., a manufacturer of returnable plastic trays, pallets and dollies, in Pleasant Prairie, Wis.

Managing the balance between modular design demands with monobloc design interests creates a tug of war between competing needs, adds Wilcox. Incorporating designs that allow easy access for cleaning, product or packaging removal, increased machine monitoring and management capabilities or product flow management adds complexity.

As the economy has declined, secondary packaging equipment began undergoing the same design transformations as primary packaging equipment, experts agree. In general, manufacturers are seeking to develop economical, energy-saving machines and striving to produce compact designs with space-saving footprints. Energy-efficient machines also contribute to cost savings, as they help companies advance their sustainability benefits, so the benefits to users are two-fold.

Many equipment design challenges stem from the constant need for change, according to Tom Egan, vice president, industry services for the Packaging Machinery Manufacturers Institute (PMMI), Reston, Va. He says brands are always exploring ways to improve the manufacturing process, which could involve using lighter, eco-friendly materials, streamlining operations or accommodating new products on the line.

Changes of this nature often prompt additional change across the line. “If a snack producer introduces corrugated boxes that use 20% less material, they will not run the same way as the original, heavier boxes do,” he explains. “Adjustments will have to be made to machine speeds to ensure that the boxes do not shift out of place and jeopardize the efficiency of the line—or worse, result in damaged product.”

Sanitation also is an important factor in machine design, especially to accommodate new food-safety regulations, according to Kerber. “A significant portion of our business is with frozen and chilled foods producers, and we meet the high-level requirements of these environments,” she notes. “However, companies that produce snacks, bakery items and other ‘dry’ foods are increasing their sanitation requirements as well. As a result, incorporating sanitary design elements into our base machines and offering the appropriate level of sanitary options is important in many applications.”

Dickman agrees: “We are seeing more bakery applications that require strict sanitary construction standards because many of these systems are used in applications where products are wrapped unsupported and the equipment has to be washed down frequently.”

On the move

Bakeries and snack manufacturers also are looking for secondary packaging that can help them trace the movement of products through the supply chain, according to Egan of PMMI. He says advanced marking, coding and other track-and-trace technologies are becoming more important to snack producers, especially with the implementation of the Food Safety Modernization Act (FMSA).

“The FSMA requires comprehensive tracking and tracing capabilities, expands the FDA’s ability to access records during food emergencies and requires food manufacturers to identify potential hazards and have prevention plans in place,” he explains. “As a result, more snack producers are searching for technologies that will make it easier for them to map the paths of products through the supply chain.”

Being able to track trays, pallets and other material handling equipment (MHE) is also important to bakers and snack producers, as the loss of MHE represents millions of dollars annually. New MHE offerings from Rehrig Pacific Co. incorporate embedded or molded-in radio frequency identification (RFID) or bar-code tags and increased durability to accommodate the latest product mix in terms of primary package dimension and weight. “RFID and/or bar-code tracking helps monitor returnable assets, which reduces loss rates and replacement costs,” notes Rindfleisch.

Packaging trends

Like secondary packaging equipment, secondary packaging materials continue to evolve, too, to meet bakers’ and snack manufacturers’ changing demands and needs.

Norfolk, Neb.-based ThermoPod, for instance, offers shipping cases lined with environmental-friendly insulation. “Everyone seems to be looking for a green alternative to nonbiodegradable expanded styrene foam insulation,” says Roger L. Borgman, national sales manager. “Our insulated envelopes (ThermoPods) and box liners (ThermoKeepers) are made from a blend of recycled cotton and wool fibers. The liners are manufactured in a variety of thicknesses (R-value) and are designed to fit into a customer’s existing size shipper.”

Food manufacturers also want to make their products stand out on store shelves, which is something that innovative secondary packaging can help them achieve. “With the rise of private-label products and the proliferation of competitors, packaging is a critical element in differentiating the product,” Egan says. “Product designs and techniques are not radically different in many categories, although ingredients can produce a unique offering. Still, with the right package format and graphics, you can attract the consumer’s eye to your product.”

Whether it features high-impact graphics, unique shapes or tactile aspects, secondary packaging offers bakery and snack manufacturers an opportunity to differentiate their products at the point of sale.

Kertesz also sees this as an important trend. “Due to evolving market demands, in particular product packaged in flexible bags, we have seen further migration toward shelf-ready/retail-ready packaging where the shipping case easily transitions into the display used on the store shelf,” he explains. “The end game is to provide increased value in areas of product identification, easy-open features and disposal a better shelf presence that stands out among the competition and an improved shopping experience for the consumer.”

A writer and editor with more than 30 years of experience in the editorial field, Neal Lorenzi is well-versed in many areas including packaging, converting, plant production and aggregate/mining as well as special needs, communications and hospitals.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!