What's new in packaging?

Packaging is a key component of most of today’s consumer products, especially food. Items sold unpackaged years ago, such as lettuce, eggs, cookies and bread, are now sold in plastic bags, expanded polystyrene foam cartons, polyethylene terephthalate (PET) clamshells and kraft paper bags with polylactic acid (PLA) liners.

Food safety, product protection, shelf life, in-store merchandising and transportation are a few reasons why bakers and snack manufacturers package their products. “Then, many foods are too delicate or small to sell unpackaged, such as pies, cookies and a host of snack foods.”

If asked, most consumers would agree that the baked goods and snack foods they buy require packaging for the very reasons bakers and snack manufacturers use packaging. What they may not agree on is the convenience or effectiveness of some of the packaging they encounter. After all, who hasn’t complained about a bag or box that was difficult to open or reseal, didn’t keep its contents fresh or was impractical to store?

Bakers and snack manufacturers are working with packaging manufacturers to address these issues to keep their customers happy and retain them. “For many consumers, the package is the product,” says Yasmin Siddiqi, global development director for DuPont Packaging, a division of E. I. du Pont de Nemours and Co., Wilmington, Del., which supplies resin to film converters for the food, beverage, healthcare, personal care and cosmetics industries. “If you have a bad experience with a package, you might not be a repeat buyer.”

Packaging material suppliers are doing their part, too, to help food packaging manufacturers develop more innovative packaging by also staying on top of issues impacting the food industry.

Food safety

Food safety is the number-one concern for food processors. Packaging plays a major role in protecting products from bacteria and other contaminants.

“Last year, there were a number of recalls in the U.S. due to listeria and samonella,” says Siddiqi. “The [food] brands [manufacturers] want to produce quality products. The implication for us, as a supplier, is how do we produce safer packages? We are looking at how we can improve sealing performance, so that what’s inside a package stays in the package and what’s supposed to stay outside [of a package], stays out.”

DuPont’s Surlyn adhesive resin enables users of “bag-in-box” packaging, like that often used by cracker and cereal manufacturers, to achieve a proper seal on box liners to keep contaminants out, while still being easy to open by consumers.

Packaging material suppliers are also offering materials that don’t migrate into food or affect their taste or smell. One such food-industry staple, polyethylene terephthalate (PET) resin, is used to make the hinged, transparent clamshells commonly used for delicate baked goods and bulk snacks.

OCTAL Petrochemicals, Muscat, Oman, recently took PET one step further with its DPET direct-to-sheet process, which eliminates the five stages of the conventional sheet production process to produce PET sheet not exposed to possible contaminants. The company makes PET resin, direct-to-sheet (DPET) and DPET/PE laminate sheets. Its subsidiary, CrystalPack, produces PET containers, including clamshells, cake domes and pie trays.

“One of the key [selling points] to our customer base and our customers’ customers is that you cannot get more pure than DPET,” says COO Joe Barenberg. “What comes into our plant is liquid monoethylene glycol and a powdered, purified, terephthalic acid. It doesn’t see the atmosphere until it’s made into a calendared sheet. The traceability and purity is absolutely the theoretically best you can get. And whenever there’s any issue of contaminate transfer or leaching, we’ve got the most locked-down answer to the issue.”

Every flavor of everything

According to Bill Bremer, principal and senior consultant at Kestrel Management Services, LLC, a Lisle, Ill.-based consulting firm that helps clients manage risks and improve business performance in quality, environmental, safety and security, compliance with the Global Food Safety Initiative (GFSI) Standards, is having a big impact on the food industry in this area. “If you have a gas permeability ratio for a product in a flexible pouch, a box or another traditional package, you literally need to have test data to show that the packaging will not contaminate the food—like with BPA [Bisphenol A]—or that it will work functionally to protect the food,” he says. He cites a recent food recall by a major brand that was due to odors absorbed by bags stored in the company’s manufacturing plant.

“The interesting thing is, if you go back in time to the original food laws—before the Food Safety Modernization Act, which is partially driving some of this—if you followed all those rules—and they were less specific and more general—you would be in very, very good shape. I think, in the last 20 years, we’ve gotten caught up in the global market, changing consumer preferences and innovation. You have every flavor of everything now. With that, there’s been less of a disciplined approach on development, including packaging. For 25 years, we’ve been in a period of significant outbreaks of food contamination. Now, the laws are changing. We have the supply chain and international global requirements changing with GFSI.”

While all members of the food industry are working to improve food safety, U.S. consumers don’t seem as concerned about this issue. A recent NPD Group Food Safety Monitor survey found that from January through August 2012, just 60% of U.S. consumers, on average, were somewhat or slightly concerned about the safety of the U.S. food supply, while only 25% were extremely or very concerned and 15% weren’t concerned at all. The 2012 levels were on par with previous years.

Packaging convenience

Consumer convenience has been a major force driving packaging material suppliers, packaging manufacturers and food processors to improve food packaging.

“Convenience is an important focus for packaging manufacturers in this segment,” says Tridisha Goswami, chemicals, materials and foods research analyst at Frost & Sullivan, a Mountain View, Calif.-based growth partnership company that provides consultative and research services. “With busier lifestyles, single-use/single-serving packaging is gaining ground and is expected to be an influential trend in the market.”

Greg Bunker, group marketing director, food and special packaging, The Dow Chemical Corp., Midland, Mich., concurs: “With many Americans living ‘on-the-go’ lifestyles, consumers are moving away from packages containing multiple servings to single-serve packages. For example, nuts and olives that were traditionally packaged in glass or metal containers are now in flexible packaging. Resealable and easy-to-close packages continue to grow in popularity.”

Dow offers a wide range of products used to manufacture packaging for the baked goods and snack foods industries. Last October, the company introduced AGILITY Processing Accelerators, which are specifically designed to increase blown and cast film line output through improved bubble stability and processing. Applications include flexible food packaging.

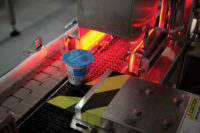

Siddiqi notes that because people are taking food to school, work and other places, they want packaging that’s portable and easy to handle. “Think about yogurt,” she says. “You have a rigid container with a lid on top. You have it in-transit. You want it to be sealed the whole time. When you go to open it, you want it to be easy to open and not have the yogurt splatter all over you.”

Lidding sealant resins, such as those in DuPont’s Appeel line, enable consumers to easily remove the container lids of a host of other on-the-go products, including single-serve fruit and pudding cups, crackers, mini cookies and chips.

But on-the-go consumers aren’t the only ones who want easy-to-open packaging. “This is also becoming particularly important with aging consumers, who find it a lot more difficult to maneuver packages,” says Siddiq.

According to the Pew Research Center, about 10,000 Baby Boomers will turn 65 each day until 2030, giving food packaging manufacturers, bakers and snack producers lots of incentive to improve their packaging.

And while it’s important to consumers to be able to easily open a bag of potato chips or carton of donuts, it’s equally as important to them to be able to reseal these containers easily. “We are hearing a lot about recloseable containers, and we do have a couple of innovations for recloseable solutions in our Surlyn line combined with another technologies,” Siddiqi says.

Siddiqi cites a resealable Oreo cookie package introduced by Nabisco World several years ago. “It’s a great innovation,” she says. “One of the benefits of having a reclosable package is that, instead of having to transfer your product into a zippered bag or cookie canister, you keep it in the bag. So, guess what? You’re constantly seeing Nabisco on the bag.”

Packaging and sustainability

As Americans become more environmentally aware and proactive about recycling and sustainability, many are taking a closer look at how the products they’re purchasing are packaged and whether these materials are and can be recycled. Some are even basing their purchasing decisions on a product’s packaging, and packaging material suppliers, packaging manufacturers and food processors are taking note.

“Sustainability is gaining ground, and companies are forming partnerships or investing in product development for better-performing and lightweight packaging alternatives,” says Goswami, adding that polymer companies like BASF have developed 100% compostable snack packaging.

Siddiqi agrees that sustainability is big trend in the food industry, but adds that it has “many different meanings to different people. Depending on the brand or the region of the world or country, it can mean different things. It’s about reduction, recycling, renewable [materials] and product protection.

“Sustainability is also a key area regarding food waste. There will be 9 billion people on the Earth in 2050 that will need to be fed. Right now, one in seven goes to bed hungry, so it’s really critical that we protect the food we have. More than 30% of our food is wasted, and there are 7 billion people right now. With 9 billion, it becomes even more important to protect this precious resource.”

Bunker concurs: “Worldwide, nearly 30% of all food grown is lost due to spoilage. As the world’s population continues to increase, food safety will only become more important. Our company feels that with innovative solutions and collaboration across the entire value chain this problem can be solved.

“Packaging solutions from Dow not only provide strength and higher output using fewer resources, they also serve as a solution to the global issue of food waste. These advancements can protect and reduce spoilage. With these technologies, Dow has seen a higher percentage of food moved through the supply chain to the grocery store. These innovations prevent food waste, supply people with the food they need to live a happy and balanced life and make it possible to feed the world’s growing population.”

In the end, when it comes to consumers’ perception of food packaging and what packaging manufacturers and food manufacturers should keep in mind when developing new packaging, Siddiqi sums it up best: “People want things that are healthy and safe. They want to make sure their product is fresh and safe. They don’t want to have any issues. They want things that are convenient, and they want it differentiated. They want to feel like they’re doing good for the planet, but they want it affordable, and they want value.”

The flexibility factor

Walk into any grocery store, and you’re sure to see plenty of baked goods and snacks in flexible packaging—frozen dinner rolls, crackers, chips, snack nuts and more. “In the flexible packaging market for food and beverage applications, the bakers and snack food sub-segment has 20 to 25% of the market,” says Tridisha Goswami, chemicals, materials and foods research analyst at Frost & Sullivan, Mountain View, Calif. “Polymer and plastics packaging are replacing paper bags in this market due to cost and performance advantages.” Some food manufacturers are moving away from glass containers to flexible packaging for years. “A major market for the food packaging industry is the transition from traditional glass containers to standup flexible pouches,” says Greg Bunker, group marketing director, food and special packaging, The Dow Chemical Corp., Midland, Mich. “One recent example is salsa. In the past, shoppers could only find their favorite salsa packaged in glass jars. Now, many are found in standup pouches. This type of package is lightweight, requires less energy to produce and transport and eliminates any potential safety hazards.” Meanwhile, Bill Bremer, principal and senior consultant at Kestrel Management Services, LLC, Lisle, Ill., says his company is seeing a movement toward more “rigid” flexible packaging and standup pouches. “Standup pouches are really continuing to expand,” he says. “They came out in consumer products about 15-20 years ago. They’re a very hot, growing segment. You can put them on a shelf or hang them on a rack.” “They’re typically sophisticated, multilayer structures and recycling any of that is a real challenge,” says Joe Barenberg, COO of OCTAL Petrochemicals, Muscat, Oman, of flexible packaging. “In my observation, they’ve sort of found their way into things that maybe they’re not quite the optimal package for, but, like a pendulum, that will swing back to the right equilibrium. [Flexible packaging is] a good format for very specific things, especially if you need high barrier.” |

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!