The Power of purple

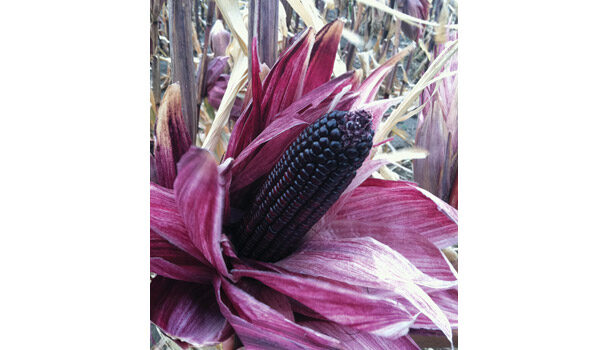

Corn comes in many colors. But did you know that one color of corn has health benefits dating back to ancient times? Axium Foods, a maker of corn-based snacks and tortilla chips located in South Beloit, Ill., discovered that purple possesses powerful antioxidant properties and has launched Mystic Harvest Purple Corn Tortilla chips, made from all-natural ingredients, including antioxidant-rich purple corn. Such corn contains powerful anthocyanins, or flavonoid pigments found in red/purplish fruits and vegetables, made from purple cabbage, beets, blueberries, cherries, raspberries and purple grapes, that serve as antioxidants important for good health.

The purple corn tortilla chips are what Axium Foods, a division of McCleary Industries, calls an exciting new superfood. Crunchy and flavorful, the chips are available at retail in 7-oz. bags priced at $3.39 in Authentic chips with Sea Salt and Multi-Grain varieties. Distribution is currently across six Midwestern states. The new chips are also gluten-free and have 130 calories in a 1.5-oz. serving, 6 g. of fiber and 4 g. of protein.

According to a recent study published in The American Journal of Medicine, a diet rich in antioxidants can significantly reduce the risk of heart attacks. Grown to deliver consistent color, texture, distinctive taste and one of the deepest, most vibrant purple hues, purple corn originated in the mountains of Peru more than 3,000 years ago and was once believed to have mystical healing powers. But the secret to purple corn is the anthocyanins plant pigments that occur naturally and give the corn its dramatic, deep-purple hue. The anthocyanins have demonstrated a wide range of benefits in numerous studies.

The power of purple

Purple corn packs a 25% more powerful antioxidant punch than a serving of blueberries, according to Axium Foods. Based on Oxygen Radical Absorption Capacity (ORAC) scores, one serving (1.5 oz.) of Mystic Harvest Purple Corn tortilla chips has an ORAC score of 6,000, it says. The higher ORAC score, the higher the antioxidants. A serving of blueberries has an ORAC score of 4,669. The purple corn in the chips is a proprietary, non-genetically modified organism (GMO) hybrid and has been cultivated from ancient species.

The unusual chips got their start in November 2010, after Axium Foods president Jerry Stokely underwent bypass surgery to repair severely clogged arteries. All of this was a wakeup call for Stokely, who not only began thinking differently about his health but also about the health of Americans in general. Examining his experience as a way for Axium to make better-for-you snacks, Stokely and the rest of the Axium team investigated various ingredients and learned about purple corn and its advantages of concentrated levels of potent antioxidants.

Step in the right direction

“Over a number of years, the healthy trends have really emerged with better-for-you products, lower sodium, zero trans-fat oils and natural ingredients,” Stokely says. “This is a step in that direction. What we’re doing with purple corn and where Mystic Harvest was born came from our business relationship with the investors of a company that provides purple corn. We sat down together and we really started to see purple corn’s benefits.”

While Stokely says Axium could have taken another healthful road, such as the low-fat or low-sodium route, to develop a new chip, the antioxidants in the purple corn and the fact that purple corn is a nonGenetically Modified Organism (GMO) were critical to the company’s decision to investigate further. “It is more than antioxidants,” he points out. “Purple corn isn’t genetically modified, which is an emerging concern.”

Axium validated the health claims of the purple corn in an independent laboratory and with that, decided to create a tortilla chip that could bring purple corn’s benefits to consumers, naming the brand Mystic Harvest after the ancient grain’s unusual and powerful properties. “We decided to create a strategic, exclusive relationship with the corn supplier, where both companies could benefit to introduce a product [containing purple corn],” Stokely points out. “While we’re using it in snacks, the supplier is also investigating the use of purple corn on the nutraceutical side of the business and in natural colors that they can extract.”

Axium’s 130,000-sq.ft. production facility in South Beloit has seven production lines, two of which were added a few years ago. The company took the purple corn through its processes and made a few changes to best preserve the anthocyanins present within the purple corn, recalls Cindy Kuester, vice president of sales. “We did that to ensure that we could keep as much of the antioxidant power within the purple corn as possible,” she explains. “The product also has to look appetizing and especially must taste great. Consumers might try it once, but if it doesn’t taste good, that’s it.”

Adds Stokely, “That’s the point of entry for any snack—it has to be satisfying. You have to look forward to eating it, and it has to have a good taste and good texture. We wouldn’t want to put it on the market if it was something other than that.”

After a year in development, Mystic Harvest chips debuted at the Natural Products Expo West in March of this year as the first national brand of tortilla chips made with antioxidant-rich purple corn. The chips have since been exhibited at the Expo East show in an additional 1.5 oz. single-serve size. This smaller size has become increasingly important to the growing number of health-conscious consumers who eat their snacks on the run, says Kuester.

So far, there is an ample source of supply of the corn, which is grown in Minnesota and Wisconsin. “We have a significant supply at this point, and the source is growing, so as you can imagine, scaling up is a longer-term proposition,” Stokely says. “We’re essentially three years into the growing cycles and are making exponential leaps in the amount of corn available.” And it’s all grown by a grower cooperative, so this penetrates the ownership of the corn and the purple corn penetrates down to the actual growers who own the company.

Axium has been in contact with schools that are looking for better-for-you-type items, Kuester says. “One of the key components of this product is that it’s higher in fiber than traditional tortilla chips, so you get fuller faster. That helps with moderation, which is part of the growing health and wellness trend.”

The Sea Salt variety of Mystic Harvest purple corn tortilla chips is also gluten-free, while the Multi-Grain version incorporates whole-grain buckwheat and whole-grain wheat. Both have added fiber and no sugar, trans-fats or cholesterol. “Consumers are very sophisticated today,” she says. “They’re going to snack, but they’re trying to make better choices.”

Consumers appreciate the benefits. “We created the Mystic Harvest brand upon a foundation of stringent values that ensure all products in the line deliver better-for-you nutritional benefits to consumers,” says Stokely.

Tried and true

Family-owned and operated, Axium Foods has been in business more than 50 years, building on its product lines. The company dates back to 1960 through innovative entrepreneur and founder Eugene “Mac” McCleary, who designed and built production machinery, developed various snack recipes and invested in his people. An inventor who found great success in the copacking business, McCleary originally worked for the Adams Corp., and was directly involved in the production of the first crunchy cheese curls. Today, his proud company is confident that its commitment to the quality and innovation set forth by McCleary will continue for many years to come.

The bulk of company’s business is in copacking and manufacturing products for private-label store brands, which are usually priced lower than name brands. Axium’s own brands account for approximately 12% of its business today and counting. It also makes other snacks such as trans-fat-free, restaurant-style tortilla chips using white and yellow corn grown in the Midwest and crispy corn chips. Marketed under the Fiesta Crunch and Pajeda’s labels in bag sizes from 5 to 18 oz., the products cater to what Axium says are “serious tortilla chip cravings,” and deliver with a satisfying crunch. The Fiesta Crunch products feature multigrain tortilla chips and, for those with an intense craving to be different, flavors such as Spinach Artichoke, Ranch, Tomato Cilantro, Cheesy Bean Burrito, Jalapeno Cheddar, Pepperoni Pizza and even Bacon & Blue Cheese, all guaranteed to delight the taste buds.

Other corn-based snacks in Axium’s lineup include its top-selling Pajeda’s corn chips, as well as crunchy and puffed cheese curls, onion rings and caramel corn. Available in 11 varieties, Pajeda’s are distributed in several markets through small, independent grocery chains. Flavors include Nacho Cheese, which is a number-one seller. Pajeda’s tortilla chips are available in several different flavors, as well as a savory party mix. The products are priced at about $1.59 a bag, an incredible comparison to $3.99 for a similar-sized national brands, says Kuester.

Value and quality

All of the quality products fill a price niche between store brands and big snack names, or what Kuester points out are National Brand Equivalents (NBEs). “Our white round tortilla chips and our puffed cheese snacks are big sellers,” she says “We provide quality that’s the same or better than the national brands at a decent price.”

Quality must go hand in hand with value, emphasizes Stokely, who notes that Axium places immense value on its customers and their opinions. “Our customers are instrumental in selecting our bags, colors, chip shapes and everything in between,” he says. “We have interviewed, surveyed and consulted our way into our customers’ brains, stomachs and wallets to make sure that our quality, price and decisions are focused on the one thing we can’t live without: Customer satisfaction.”

What makes a product a value? “First and foremost, it’s the satisfaction consumers get after they open the bag and taste the product,” Stokely says. “For our customer and our own brands, there are two unique tests. The first is for consumers to take the bag off the shelf, and the second and more important test is when the consumer tastes the product. That’s when they make the decision to either come back or try something else. Our products must pass those tests every single day.”

A lower marketing budget keeps Axium’s products’ retail prices lower, but this can make it difficult to promote the products on a national level. But while other snack companies find it tricky to maintain such high quality at low prices during this difficult economy, Axium has been thriving. “Times like this are just when we should continue to be innovative and move forward,” Kuester states.

“With the margin pressures on regional snack producers, several regional [snack] companies have gone through significant changes,” observes Stokely. “Many of them have ended up in bankruptcy. And there was the mass consolidation of many snack companies. But private-label brands have seen a big surge. Private-label is economically driven, and I think the industry itself has adapted to that reality. In this business, we more or less must adapt to survive and find the right niche. It’s a challenge.”

Private-label brands have fared better than ever, adds Kuester. “We are amping up volumes and see great demand, without a doubt,” she says. “Since 2008, there has been an influx in the growth of private-label. We found that we’ve gotten better at making private-label products. There’s a lot of attention in the private-label [sector] now.”

Axium distinguishes its products and its business by making a big effort to understand its customers and how they do business. Kuester explains: “To get into [this business], you have to have quality product and we make it consistently—we always have. We’re also very stable with pricing, we’re very transparent with the companies we work with. Customer service is critical. You have to understand what your customer is trying to accomplish. We try to really partner and make sure we’re all on the same page across the board. We watch trends, we make suggestions. All of this is so important when you’re competing against the big players.”

Coping with the drought

Equally challenging lately for many food companies is dealing with this summer’s devastating drought, which rocked the Midwest. Being a corn-based snack producer in Illinois was indeed difficult this year, notes John Murphy, vice president of operation. “Given that we’re right in the heart of the corn belt, the drought was decimating,” he says. “The folks we work with are looking at half yields or slightly better.”

Prices are climbing and premiums for food-grade corn are going up. So are freight charges. But the company has maintained an even keel on the corn supply side and cultivating its business relationships with farmers and suppliers. “We’re assured we’ll have the corn available to meet our needs,” Stokely says, adding that commodities and commodity pricing are becoming a larger consideration for everyone in the food business.

Axium is coping, mainly because it has well-established supplier relationships and prepares as much as possible to flex with a fluctuating market and uncertainties. “The circumstances we’re facing today are unlike any in the market, at least in my memory,” Stokely admits. “I think a parallel year would be 1988, but this drought appears to be worse. But we have to look at the totality of all corn this year, and food corn is a small part of the overall crop. But [the crop in] Nebraska, for example, had fairly decent yields and there was a tremendous amount of irrigation, so a lot of our food corn, which comes from central Illinois, will be augmented with corn from other areas that were more irrigated.”

Today, the company produces nearly 150 different stock-keeping units each week, and keeps up with its increasing demands using updated production and packaging equipment, including new robotic case packers, and a recently opened 30,000-sq.ft. distribution center down the road.

Uncompromising on food safety, Axium is also certified with the Safe Quality Foods Institute (SQF) at Level 2, and asserts that all senior management be SQF practitioners. “Food safety is so critical,” Stokely says. “It’s not optional. Our practitioners have to complete a Hazard Analysis Critical Control Point (HACCP) training course, maintain HACCP-based food-safety plans and have an understanding of the SQF Code Level 2 and the requirements to implement and maintain SQF systems relevant to the supplier scope of certification.

“It’s incumbent on us as food manufacturers to adhere to safe quality foods standards,” he adds. “Everyone in the organization must understand that this is the bar of entry. If we cannot do this, then we shouldn’t be in the food business. ”

Communication is key

As with any unusual or unique product, conveying the benefits of Mystic Harvest and explaining why consumers should try the purple chips are critical. Beautiful packaging helps, and the company engaged graphic designers and its marketing teams to develop luxurious matte-gloss metalized polyester bags displaying eye-catching close-ups of purple corn in the husk and other bucolic elements in shades of gold-orange and, of course, purple. “You don’t have long to catch the consumers’ eyes, so we wanted a very nice look,” Kuester explains. “A new brand has to be very eye-catching. We received a lot of positive feedback on the packaging.”

In addition, with Mystic Harvest, there will be some educating of retailers and consumers about purple corn and its advantages. “Many people have heard of blue corn, so we need to explain the differences between this and blue corn,” says Stokely. “We need to explain to retailers all of the benefits and how to communicate those benefits to the consumer. So how we drive that home is important.”

And the consumer response to the deep purple chips? “They love them,” Kuester says, smiling. “Consumers read the label and learn about the antioxidants, and they’re excited that the chips taste great and that they get a health benefit from them. ”

More snack concepts are in the works for a Mystic Harvest line expansion. “Right now, we’re the only maker of purple corn chips in the U.S. and have an exclusive license,” Kuester explains. “We plan to expand distribution within months. We’re in the process of making some modifications and will add more varieties soon. It’s an exciting product targeting the healthy market, so we look forward to making the chips as widely accepted as possible.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!