State of the Industry 2024: Gum sales continue to increase

Challenges persist, but producers are enjoying fairly solid business.

Photo by Jenni Spinner

Consumers are still putting gum into their shopping carts (and their purses, pockets, and backpacks) on a fairly frequent basis. However, while sales of all types of gum have been relatively positive, producers in the category face many of the same categories that manufacturers in other areas wrangle with—as well as a couple of issues unique to gum.

Market data

Gum sales overall experienced decent growth for the 52-week period ending June 16, 2024, according to market data from Circana (Chicago)—the market increased 6.7% compared to the previous year, hitting a total of $3.4 billion. However, unit sales for the same time decreased by 2.2%.

Sugarless gum fared better than its counterpart, with a total of $3 billion constituting a 7.7% increase in dollar sales; unit sales even increased, albeit slightly (just 0.6%). Sales leaders included:

- Mars Wrigley Confectionery: $1.7 billion, up 8.1% for the year

- Perfetti Van Melle: $884.8 million, an increase of 8%

- Hershey: $440.8 million, an increase of 4%

Companies to watch include Rev, whose $10.7 million constituted an increase of 106.8% compared to the previous 12-month period; and The Pur Co., a company whose $8.6 million in sales represented a 80.6% increase.

Regular (i.e. not sugarless) gum both had a much smaller market share and larger decreases in general. The subcategory took in $413.6 million, a drop of 0.1%, with a drop in dollar sales of 13.2%. The top-ranking companies in regular gum were:

- Mars Wrigley Confectionery: $256.5 million, down 0.1%

- Concord Confections: $59.6 million, a 3.3% increase

- Hershey: $43.7 million, up 17.6%

Ford Gum & Machine (makers of Big League Chew) had one of the largest losses, 28.3%, bringing the company’s sales for the period down to $12.3 million. Then, Charms LLC took in just $2.3 million but that figure represented a 63.3% jump, and the company’s unit sales were up 45.9% for the year.

Looking back

Ian Kessler, national sales manager with Choward’s, says candy overall has fared better than many other food categories because of consumers’ desire (or maybe their need) to treat themselves.

“During the higher inflation period, candy seems to still be the comfort food that consumers fall back on candy when they need a fix, so we have experienced slower but sustained growth during this same period,” he observes.

Mike Gilroy, vice president of trade development and sponsorship with Mars Wrigley Confectionery, remarks that consumers have been expecting more from their gum than in the past, a trend producers should be cognizant of.

“Previously, gum was all about freshening breath—now, we’re seeing consumers turn to gum in different ways, and for different occasions,” he shares. “They’re being more intentional about when they choose to chew, meaning that innovations must be thoughtful about the way they meet them there. Brands like Extra Gum have started to explore this territory for work and study occasions, specifically when it comes to moments of focus, since some studies have shown that chewing gum can help maintain focus and attention.”

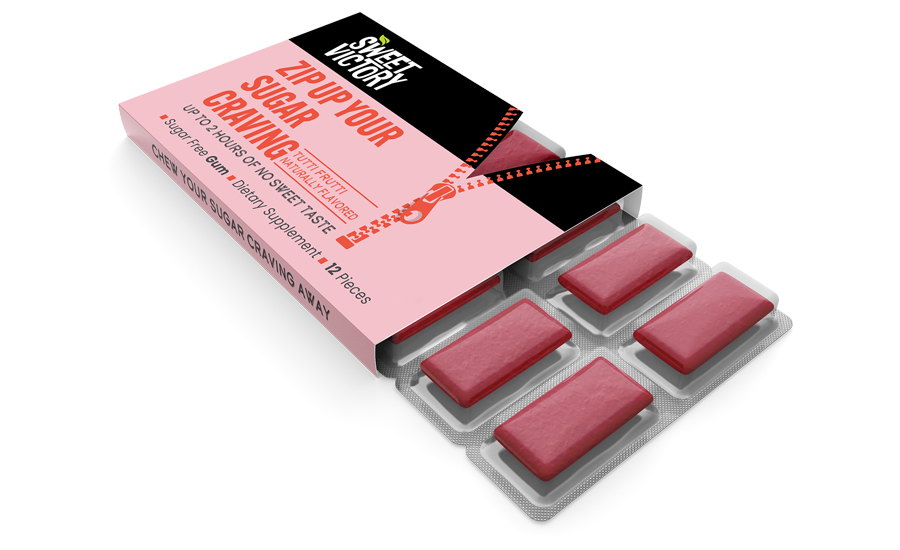

Gitit Lahav, co-founder of Sweet Victory, concurs that functional candy and gum are increasingly attracting consumer dollars.

Courtesy of Mars Wrigley

“We have seen significant growth from traditional confectionery producers who have successfully launched new production lines of functional candies,” she observes. “These producers have leveraged their expertise in taste and texture to create products that meet the growing demand for health benefits in a familiar format. Consumers are increasingly looking for functional confectionery that seamlessly fits into their daily lives, offering benefits such as enhanced energy, improved digestion, or reduced sugar cravings, all in a form that resembles traditional sweets.

While sales have been healthful, Kessler opines, anxiety induced by the challenging economic conditions could be having a discernible impact on what candy and gum retailers place on their shelves.

“During tougher than normal financial environments, traditional retail stores tend not to bring in new items, they stick with the brands that have been performing for them—therefore the opportunities of gaining additional market share or more retail outlets becomes more difficult,” he says, adding that the company has pivoted by focusing increased efforts on driving online and direct-to-consumer sales.

Gilroy says Gen Z gum preferences for things like varying textures, functional benefits, and on-the-go and sharing packages have helped fuel recent product innovations at Mars Wrigley.

“Bringing a fan-favorite Orbit flavor to a new whitening form, White Sweet Mint soft chew gum delivers a confidence boost with every refreshing bite,” he states. “Consumers already love Orbit’s Sweet Mint flavor for its clean and fresh taste, and now they can try it with a crunchy exterior and chewy center bursting with delicious, sweet mint flavor, sold in a bottle perfect for taking on the go and sharing with friends.”

Other recent Mars Wrigley gum launches include a Hubba Bubba bubble gum that incorporates the fruity flavors of Skittles, a candy brand also under the company’s umbrella—the crossover item landed a Most Innovative Product award at Sweets & Snacks Expo 2024.

Looking forward

Lahav predicts the demand for functional items will increase in the near future—good news for functionally focused producers like Sweet Victory.

“One of the most notable trends from the past year that we believe will continue to grow is the expansion of innovative functional candies,” she forecasts. “Consumers are increasingly seeking solutions for everyday problems in convenient, enjoyable formats. In the gum industry, alongside our Sweet Victory gum that helps with sugar-related issues, there are already gums designed for energy, smoking cessation, and more.”

Kessler says while challenges will persist, gum producers have reason to remain optimistic in coming months.

Courtesy of Sweet Victory

“We believe that we will see the continued growth in the gum sector, with more traditional flavors in the sugarless space,” he remarks.

Additionally, Kessler predicts that while consumers may be increasingly interested in better-for-you candy, gum and other treats, regulatory forces also likely will have an impact in the near future.

“The industry, because of the shift in the E.U. away from colors, is putting more pressure on manufacturers globally to move away from traditional colors and move into the natural color space,” he says.

Lahav confides that relatively new companies like Sweet Victory especially will face challenges—regulatory obstacles as Kessler mentioned, and a list of others—in coming months.

“The key challenges we face include finding the right local partners in the right markets, navigating complex regulations, and managing budget constraints as a small startup,” she says. “Each market has its unique set of regulatory requirements and consumer behaviors, which necessitates a tailored approach and significant investment in market research and partnership development.”

Lahav says her relatively young company has more new items to watch out for.

“Following the success of our Sweet Victory gum, we are now working on introducing new flavors and expanding our applications; we plan to offer soft and hard candies that provide the same craving-reducing effects as our gum,” she says. “While we cannot reveal specific details just yet, our ongoing commitment is to develop innovative solutions that address everyday health concerns in enjoyable formats.”

In contrast, while C. Howard has a long track record of offering longtime favorites in the gum category—the producer is celebrating its 90th anniversary this year—Kessler reveals innovations also are on the horizon.

“Without revealing too much information, Choward’s is developing new sugarless gums to be released Q4 2024; more information to follow,” he reveals.

Gilroy says keeping on top of what gum buyers want will be key to future innovation and success.

“Mars consistently keeps a pulse on what motivates consumers—rolling out on-trend offers within the gum category,” he states. “The category’s growth will likely continue to be driven by more intentional chewing and different functionality beyond freshening breath, such as aiding in focus.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!