Halloween 2020

How Hershey is preparing for Halloween amid COVID-19

Company is leaning into earlier start to the season and geographic differences

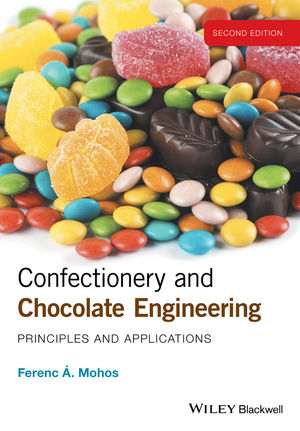

Halloween is very likely to be impacted by a world still grappling with COVID-19 — but Hershey is optimistic about the upcoming holiday.

Hershey cited a recent National Confectioners Association Halloween poll that showed that 74 percent of Millennial moms believe Halloween is more important than ever this year as families and communities create a new normal together.

And while many associate Halloween with trick-or-treating, Hershey said it’s actually a 10-week celebration marked by occasions from personal treats to at-home candy bowls, baking, decorating and gifting. In fact, in 2019, 37 percent of Halloween shopping took place before October, with in-store and online displays building anticipation and excitement for seasonal shapes, flavors and packages.

Chairman and CEO Michele Buck discussed the holiday during the company’s recent second quarter earning’s conference call.

She said Halloween is Hershey’s largest season and accounts for about 10 percent of the company’s full-year business.

“Halloween celebrations are likely to be different this year, with an earlier start to the season and more geographic differences than in prior years,” Buck said. “We expect that there will be more at-home activities, with families sharing timeless traditions and new ways for people to celebrate with neighbors.”

Half of Hershey’s Halloween product is purchased for self-consumption, as in home candy bowls. The other half is made up of trick-or-treat sales. In fact, the most popular Halloween packtypes (assortment and snack size) have shown about a 12 percent growth across the marketplace during the COVID-19 pandemic.

Consumers are continuing to purchase these packtypes for in-home treats, indicating an earlier to start to seasonal shopping as Halloween displays are set, Hershey said.

“While research indicates trick-or-treating participation will likely be below prior year levels due to COVID-19 concerns, the expectation of this holiday tradition has been consistently improving over the past several weeks,” Buck said. “We expect to outperform the category given our iconic brands, strong innovation and merchandising, and great execution.”

Much like Easter celebrations, Hershey’s ongoing consumer insights indicate shoppers will find creative and safe ways to trick-or-treat and celebrate the week of Halloween. The company is partnering with retailers to understand geographic impacts on pandemic guidelines and make week-to-week adjustments in digital media to connect with relevant messages and ways of celebrating as the season unfolds.

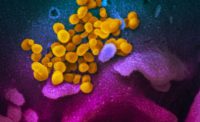

“It is an outdoor event, and it’s an event where a lot of masks are already worn,” Buck said. “There’s no evidence of the virus being passed through packaging or food, so we feel pretty good based on what we’re seeing so far from consumer feedback. But if trick-or-treat tends to be a little lower than expectation, clearly, we’ll focus even more on the ‘treat for me’ and the ‘candy bowl’ occasion.”

Hershey started getting orders back in May for Halloween products, and it has already shipped some of it. And the company expects to ship product all the way through early October.

Buck said the goal is to ensure sell-through, both before and after Halloween. Before the holiday, that means working with retailers to have the right merchandising, getting products on the floor as early as possible, and leveraging media investment to excite consumers about the holiday.

Then, to make sure they have post sell-through after the holiday, pulling back on seasonal packaging, having more everyday options, and working through mark-down plans.

“We feel good based on what we’ve seen,” Buck said. “We’ve been partnering closely with our retailers. We feel good about many retailers wanting to lean in.”

Buck also pointed to another holiday as a guide for how Hershey’s Halloween might unfold after she was asked during the Q&A if Hershey would be making any drastic changes to its business model as a result of COVID-19.

“Given the results that we saw on Easter, which was really in a peak period of people being told not to go grocery stores, and we still had a pretty decent Easter,” Buck said. “Obviously, we will all learn more as we go through every one of these, but at this point in time, I don’t see a major business model shift needing to come from that.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!